The Stablecoin Tug-of-War: Battle of the Giants (Part 2)

Tether or USDC? The DeFi Market's Changing Preference

In this three part series we analyze stablecoin DeFi market dynamics, focusing on TVL1 and yields. We segment the market into fiat-backed stablecoins and crypto-backed stablecoins.2

In part 1, we focused on the broad market and compared trends between the fiat-backed3 and crypto-backed stablecoin segments. In this part we focus in on the fiat-backed segment. We especially focus on regime changes post USDC de-peg, which occurred on March 11, 2023.

Summary

In the fiat-backed stablecoin space within DeFi, USDC and USDT stand out as the top players, dwarfing the competition4.

The de-pegging of USDC has flipped the market dynamics, with standalone USDC risk now being priced higher than USDT.

USDC has slowly been losing DeFi dominance going from a market share of 66% just before its de-peg to 56% as of May 12, 2023. Most of this market share accrued to USDT, with minor growth in other fiat-backed stables.

USDC has slowly lost market-share after it briefly lost peg in March

As highlighted in part 1, after USDC's de-pegging, stablecoins' total value locked (TVL) in DeFi has largely reached a steady state. The below chart shows TVL for fiat-backed stablecoins.

The following charts display TVL for fiat-backed stablecoins and the same data normalized for total TVL.

Key trends observed as of May 12, 2023:

USDC's market dominance is dwindling, dropping from an average of 68% in the past year to 56% as of May 12.

USDT has benefitted from USDC’s decline, gaining market share to 35%, compared to average over last year of 26%.

While BUSD, USDP, and TUSD have experienced slight growth in market share, they remain relatively insignificant, with GUSD barely registering on the chart.

Fiat backed yields have increased year to date

Not much else to say here other than that yields have been increasing. In part 1 we dove more into the drivers of yields broadly.

The DeFi market may be beginning to see increasing USDC risk relative to USDT

We're witnessing a significant shift in the yield spreads and risk perception between USDT and USDC. Historically, USDT has been seen as higher risk than USDC.

The subsequent chart illustrates this by comparing the USDT-USDC yield differential across both single side yields (includes lending protocols, as well as single side staking)5 and DEX yields6. A positive value signifies a higher yield for USDT than USDC, and vice versa.

Key observations:

USDT's yield for single-sided liquidity provision has sharply declined against USDC, suggesting that the market sees USDT as less risky than USDC.

Conversely, DEX yields are higher for USDT pools compared to USDC, likely due to increased trading fees from a surge in USDT demand, as corroborated by the growth in USDT market share noted earlier in the article.

Exodus from USDC single side markets driving rates

After the de-peg, USDC single side depositors have been exiting en masse. This has driven up USDC rates relative to USDT.

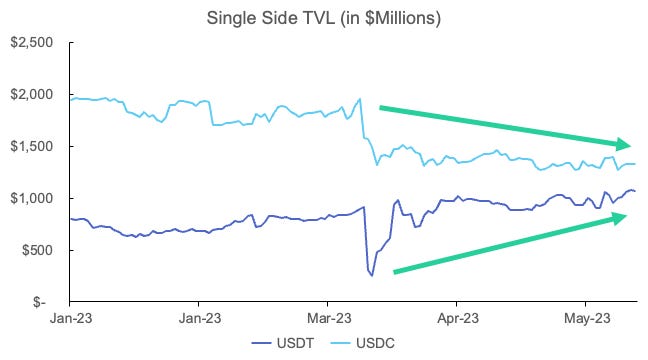

The below chart shows single side TVL broken down by fiat-backed stablecoins. The rise in USDT relative to USDC can clearly be seen.

Year-to-date data clearly demonstrates this trend, with over $1 billion USDC leaving DeFi single side markets from March 9 to May 12, 2023.

Closing thoughts

The recent developments in USDC's role within DeFi signify a remarkable shift from its pre-de-peg status. The increase in yields and the comparative decrease in TVL in relation to USDT raise noteworthy concerns, especially considering that USDT was, until recently, the primary focus of risk-related apprehensions. Other fiat-backed stablecoins have not made any significant inroads, indicating a lack of substantial diversification alternatives.7

Given this backdrop, crypto-backed stablecoins may offer a promising avenue for stablecoin diversification, a topic we will delve into in part 3 of this series.

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

TVL is a measure of the value (usually in USD terms) actively interacting with DeFi applications.

Data sources used throughout this article: defillama.com, Beefy.finance, Coingecko, DigOpp internally produced data

Brief description of each stablecoin mentioned in this article:

USDC (USD Coin): USDC is a stablecoin issued by the Centre Consortium, a collaboration between Circle and Coinbase.

USDT (Tether): Tether (USDT) is a popular fiat-collateralized stablecoin, issued by Tether Ltd. Tether has often been the subject of ridicule in crypto markets for their lack of transparency.

BUSD (Binance USD): BUSD is a USD-denominated stablecoin issued in partnership between Binance and Paxos. Minting of new BUSD has recently been banned.

USDP (Pax Dollar): Formerly known as Paxos Standard (PAX), USDP is a stablecoin issued by Paxos Trust Company.

TUSD (TrueUSD): TrueUSD is a USD-pegged stablecoin that provides its users with regular attestations of escrowed balances, aiming to create a trustworthy and regulatory-compliant cryptocurrency. It is issued by TrustToken.

GUSD (Gemini Dollar): Issued by the Gemini exchange.

GUSD is used as collateral in MakerDAO (see link). The MakerDAO TVL collateral is not captured in this analysis as it is not yield producing.

Single side protocols include both lending protocols (e.g., Aave, Compound) and single side staking protocols (e.g., Stargate). The TVL data for lending protocols here is “available liquidity” (i.e., total lend supplied minus total borrowed)

DEX yields are from smart contracts where multiple token assets are deposited together in pools to enable trading between the deposited assets. Depositors are compensated by participating in trading fees.

One last thought on USDC risk not covered in detail within this article: Circle’s cross-chain-transfer-protocol (CCTP) for USDC. This is a bridge for USDC operated by Circle, allowing users to bridge the stablecoin across blockchains without using third party bridges. This is certainly an improvement from using third party bridges, but the risk that there is a bug which could lead to creating USDC out of thin air is non-zero. (see link)