The Stablecoin Tug-of-War: A DeFi Struggle for Supremacy (Part 1)

A Data-Driven Analysis of Yields, TVL Shifts, and the Crypto-Backed Rebellion

Summary

Core observations:

In 2023, yields have been increasing for stablecoins broadly, leading to tailwinds for yield producing strategies.

Crypto-backed stables have struggled to take marketshare from fiat-backed stables as measured by TVL1.

While crypto-backed have struggled to take marketshare, a clear trend has emerged where the yield spread between crypto-backed and fiat-backed stables has become deeply negative. This indicates DeFi market participants may see crypto-backed stables as lower risk and are willing to accept lower compensation for holding them.

What do stablecoins in DeFi tell us about the market?

Most discussion on stablecoins centers on changes in marketcap and stablecoin issuance. In order to gain a deeper understanding of stablecoin marketplace trends, we take a look at stablecoin use in DeFi over the last year. In particular, we look at stablecoin TVL and yields. We observe this data across 131 unique protocols and 553 yield sources.2

To simplify the analysis, we break stablecoins into two categories: fiat-backed, and crypto-backed.

Fiat-backed3 are stables centrally controlled, with a peg maintained by an institution (like Circle’s USDC, or Tether’s USDT).

Crypto-backed4 stables have pegs maintained by a decentralized protocol (like MakerDAO’s DAI). The collateral backing these stablecoins may be cryptocurrencies, like ETH, or other stablecoins, like USDC.

We focus in on stablecoin-only liquidity pools (decentralized exchanges), and stablecoin-only lending. These represent the “safest” source of yield within DeFi, as the investor is only exposed to assets which should maintain a price close to one US dollar. The yields observed in this analysis are the yields for the entire DeFi stablecoin market (or at least most of it), not focusing on the highest yield sectors.

Stablecoin TVL has stabilized post-USDC de-peg

In a move expected by very few, USDC lost peg in March due to part of their fiat backing being held at the failed Silicon Valley Bank.

TVL had already been declining for stablecoins in DeFi over the last year. Coming into 2023, there were signs of stabilization, but the de-peg brought a further decline in TVL.

However, it appears that after the de-peg, there was no further flight from the stablecoin DeFi ecosystem. Given this stability, the market appears surprisingly resilient. Currently the value of stablecoins actively engaged in DeFi activity sit around $6 billion.

Yields have become more constructive

Stablecoin yields have broadly been increasing since the beginning of the year, leading to tailwinds for yield producing strategies. The brief extreme spike in yield is around the USDC de-peg, which led to very high trading activity and fees in DeFi (which accrued as yield to DeFi stablecoin depositors).

Here we break out yields by the fiat-backed and crypto-backed categories. We also show the “Global” yield, or the yield on all stables.

However, the increase in yield is largely driven by declines in TVL

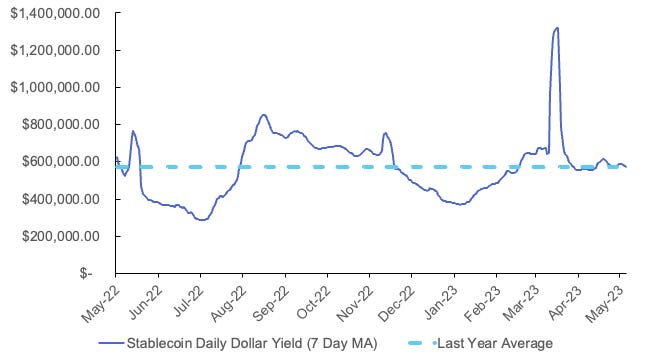

The below chart shows the 7-day average dollar return of stablecoins in DeFi (i.e., the stablecoin TVL multiplied by the daily yield). From this perspective, yields look broadly unchanged and increases in yield experienced by market participants are mostly due to others in the market being washed out.

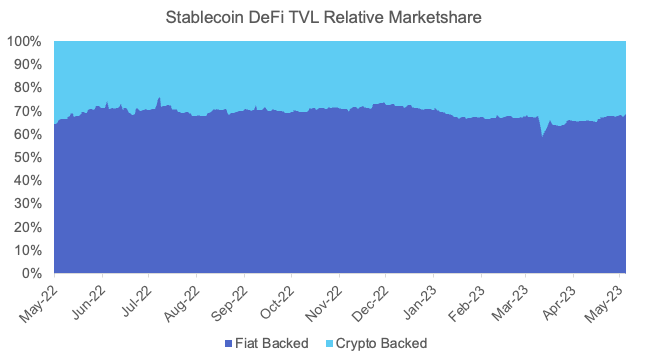

Crypto-backed stables have struggled to take marketshare from fiat-backed stables in DeFi

It is difficult to see any noticeable trends measuring the use of crypto-backed versus fiat-backed stables in DeFi as measured by their relative share of TVL.

The chart below shows this relative marketshare of fiat-backed versus crypto-backed stables. The share between the two categories appears constant, with no noticeable trends in either direction.

However, it appears as though the market sees crypto-backed stables as lower risk relative to fiat-backed

Beginning late last year, the spread between crypto-backed and fiat-backed stablecoin yield went negative. Meaning the yield received in DeFi for crypto-backed stables are lower than fiat-backed. This accelerated post-FTX collapse, and appears to have widened further post-USDC de-peg.

After the collapse of many centralized digital asset institutions over the last year and a half, the narrative of advantages of decentralized protocols over centralized entities has been gaining traction. This spread puts weight behind that as not just a narrative, but an actual market trend.

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

TVL is a measure of the value (usually in USD terms) actively interacting with DeFi applications.

Data used throughout this analysis sourced from: beefy.finance, DeFi Llama, Coingecko, and DigOpp.

List of fiat-backed stables: USDC, USDT, TUSD, USDP, BUSD, GUSD.

List of crypto-backed stables: DAI, FRAX, MIM, MAI, LUSD, ALUSD, USDD, SUSD.