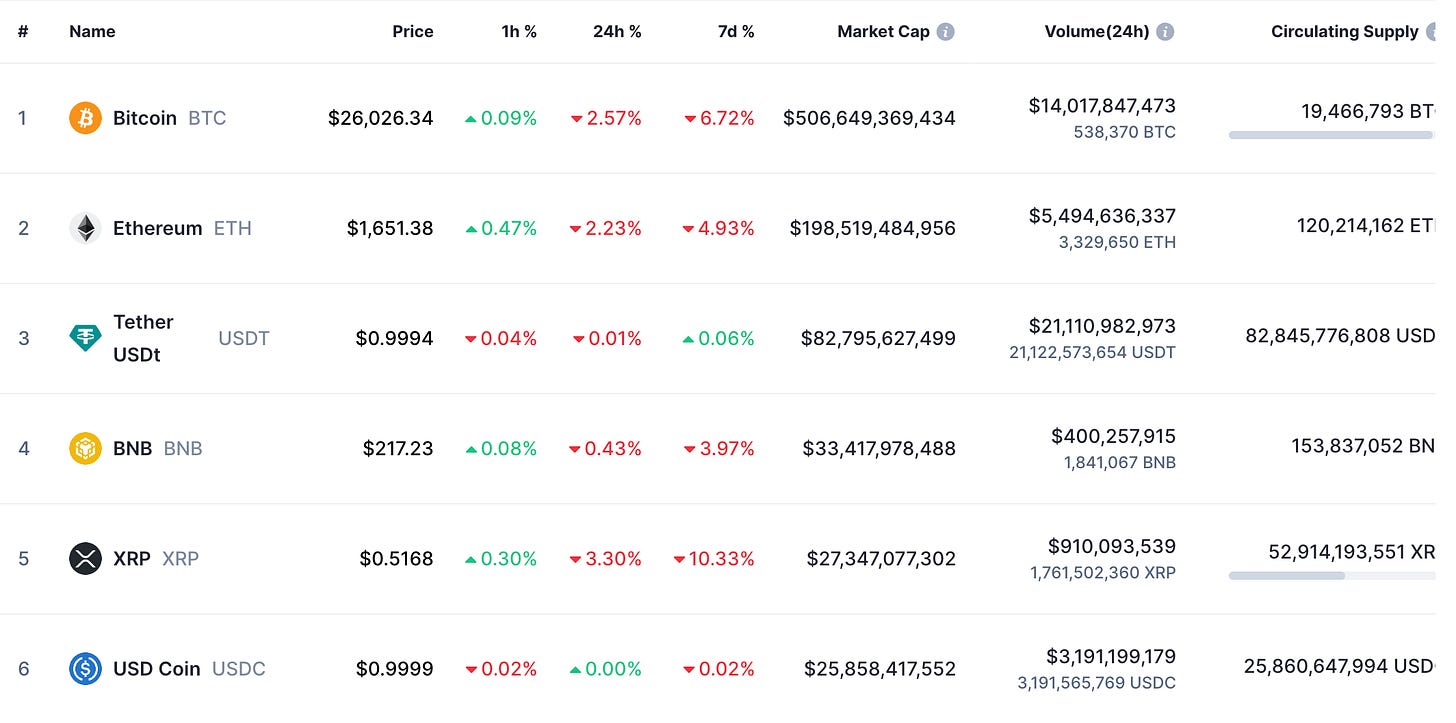

When you look at a list of the top crypto currencies by market cap, you will see a list dominated by “native tokens”. These assets are the foundational means of interacting with a specific network or blockchain. For the Bitcoin network, the native token is Bitcoin. For the Ethereum network, the native token is Ethereum or Ether. However, there are two misfits in the top 10 list. USDC and USDT are fiat-backed stablecoins and collectively represent about 10% of the total crypto market cap. Each of these stablecoins are an IOU from their issuers for $1. When you hold this IOU, you can conveniently transact in dollar equivalents on-chain.

One interesting bit is that the trustless ethos of crypto does not hold true in the strange world of stablecoins. USDT, issued by Tether, has around $83 billion in circulating tokens but has never had a legitimate audit of the accounts that “back” the tokens. Even with an audit, you would need to trust the auditors. After an audit, you will need to trust that no funny business will take place before the next audit. These are digital assets backed by attestations1, not cryptograhic proofs. For an ecosystem designed to break free of traditional banking models and fiat currencies, it seems odd that such a large portion of value is tied to these tokenized claims on a centralized party’s bank account. We don’t like that the Fed can print infinite money out of thin air, but we will accept that Tether can issue infinite USDT as long as their website says they are good for it.

DeFi has been hailed as the future of finance, creating a new system free of bank service fees by using peer-to-peer markets. Now a substantial part of DeFi activity revolves around tokens backed by fiat. Circle and Tether are able to borrow real USD for 0% from DeFi participants and make tremendous profits by putting that cash to work in traditional markets.23 These tokens have become critical to the DeFi markets because of the amount of trading pairs on decentralized exchanges that use stablecoins. If the only pool for token A is paired with USDC and the only pool for token B is paired with USDC, you would need to make a hop through USDC to swap your A for B. This requires a tremendous amount of USDC liquidity in both USDC/A and USDC/B pools to keep these markets efficient, which is great for the USDC issuers. Of the top ten pools on mainnet Uniswap, seven of the pairs include a stablecoin. Of those seven, four are pools for swapping from one stablecoin to another.

MakerDAO and their stablecoin, DAI, was marketed as a decentralized alternative. However, as recently as last year, DAI was almost 50% collateralized by USDC. MakerDAO has been working to reduce this amount and expand their treasury to include traditional investments off-chain.4 On top of that, DAI has not received the same traction as USDT and USDC, with a market cap of $5.3bn.

Are fiat-backed stablecoins crypto?

I think of them as more of a real world asset in the digital ecosystem. Similar to the wine bottle NFT’s that you can buy and trade, but eventually swap for a physical bottle.

Are fiat-backed stablecoins just fiat^2?

I think so. It is like holding dollars in a bank account, but riskier and with less upside. Because of the United States’ historical stance on crypto, using USD as the lubricant of the decentralized financial machine could be troublesome. If the US decided to cause issues with the Tether or Circle accounts, it would be a bad day for all of the digital asset world.

It seems to me that focusing more on native token pairs and less on stablecoin pairs would add resilience to the overall ecosystem.

https://tether.to/en/transparency/#usdt

https://www.wsj.com/livecoverage/stock-market-today-dow-jones-07-31-2023/card/tether-reports-850-million-profit-discloses-share-buyback-GrXH8MRuhlraRM6I1tcN

https://www.bloomberg.com/news/articles/2023-08-10/circle-usdc-stablecoin-issuer-says-1-billion-cash-to-counter-paypal-binance#xj4y7vzkg

https://decrypt.co/142801/usdc-backing-makers-stablecoin-dai-plummets

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.