Tether De-Peg: Three Things We're Seeing

In recent market moves, USDT modestly lost peg, then quickly regained losses.

A quick summary of what we’re seeing:

Tether team claims they were “attacked”.

DeFi was the canary in the coal-mine as public data allowed market to watch USDT outflows in real time.

While the peg has mostly rebounded, it looks like there are still outflows on centralized exchanges. There is a chance we are not out of the water yet.

USDT “attacked”

The Tether team claims their stablecoin USDT came under “attack” this week as it briefly de-pegged by ~40bps.

Curve 3Pool seeing USDT flows

Crypto Twitter was in a frenzy watching the Curve 3Pool (a stablecoin pool of the three most popular stablecoins: USDT, USDC, and DAI). Here is a link to 3Pool data for those interested.

The relative price of the stablecoins are set by the ratio of the assets in the pool. A perfect balance would be 33% to each of the stables. Recently, USDT’s share of the pool went as high as ~72%. A higher percent of USDT in the pool means traders are selling their USDT for other stablecoins.

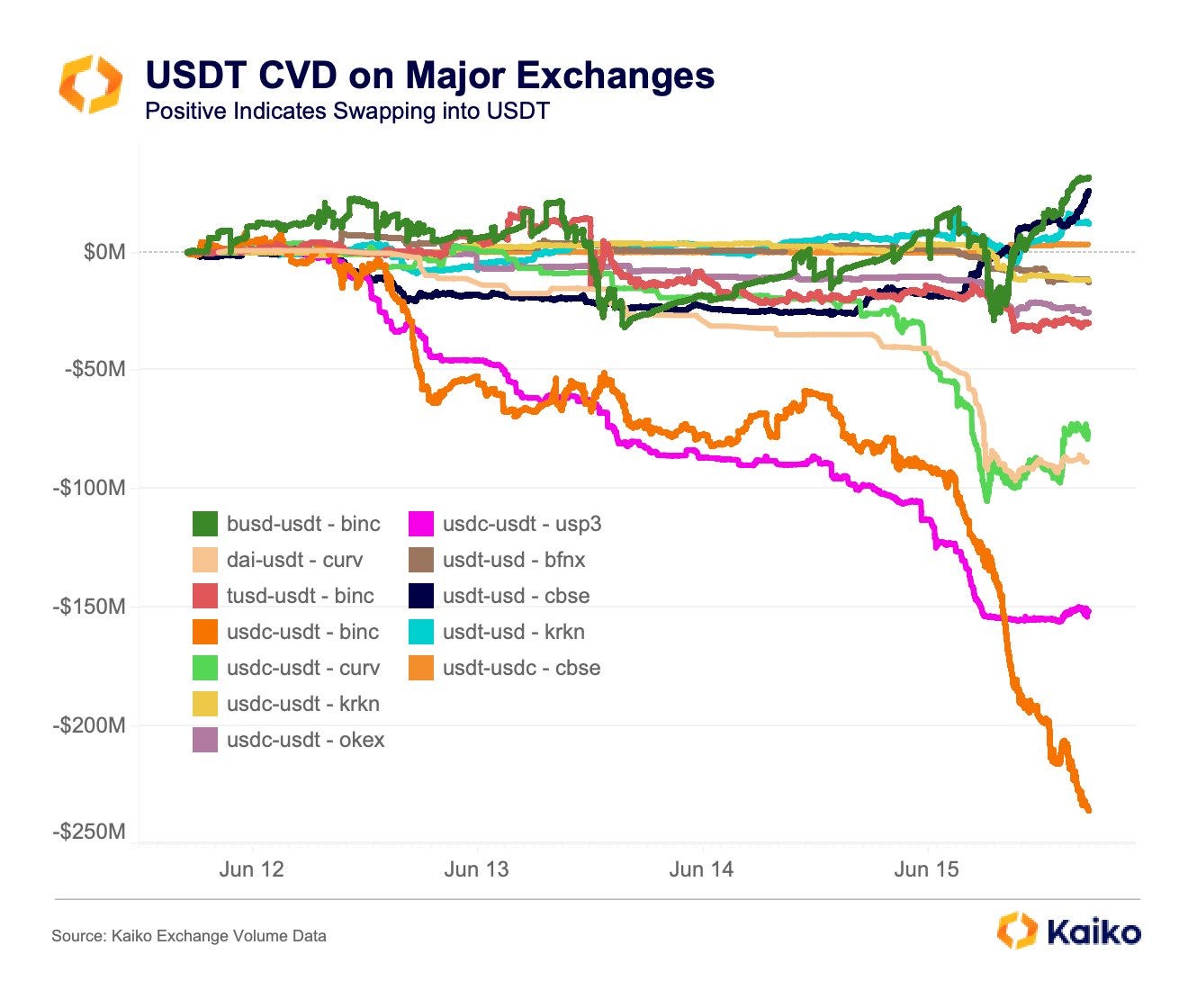

It looks like USDT outflows continue on centralized exchanges.

This useful chart, from Kaiko, shows there have been flows out of USDT on centralized exchanges as well.

This has been an interesting peg event, seemingly off of no substantial market news (other than liquidity conditions worsening for digital assets). While the peg has rebounded, the uncertainty around this event makes it mandatory to keep a close eye.

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.