The financial industry is in the midst of a significant technological evolution centered on the tokenization of real-world assets. This process, which converts ownership rights into digital tokens on a blockchain, promises to enhance efficiency, reduce costs, and expand market access. While the potential benefits are widely discussed, a crucial analysis lies in examining the specific firms driving this change and understanding how tokenization directly serves their operational and strategic objectives.

The implementation of tokenized stocks is not a monolithic movement. Rather, it is being led by distinct groups with different goals. By analyzing their approaches, it becomes clear that tokenization is a powerful tool being used to either expand retail market access or to build the foundational infrastructure for the future of finance. In both cases, the operational advantages translate directly into strategic and financial gains for the implementing firms.

The "Illusion of Decentralization" in Institutional Tokenization

Before examining the specific platforms entering the space, it is crucial to understand the nature of the technology they are implementing. Despite the use of "decentralized" ledger technology, the current wave of institutional tokenization is fundamentally centralized. The Bank for International Settlements (BIS) has critically described the notion of full decentralization in these systems as an "illusion".[1] This centralization manifests in several key ways.

First, it creates a "walled garden" effect. A clear example is Robinhood's tokenized stock offering on the Arbitrum network. While Arbitrum is a public blockchain, every transfer of Robinhood's tokens is checked against a private registry of KYC-approved wallets. This design prevents the tokens from interacting with the broader, permissionless DeFi ecosystem, effectively trapping users and assets within Robinhood's controlled environment. It is a model that uses decentralized technology to build a more efficient and inescapable centralized platform.[2]

Second, the synthetic nature of the tokens themselves reveals the underlying centralization. The controversy surrounding Robinhood's "OpenAI" tokens, which OpenAI publicly disavowed, highlighted that users were not buying actual equity but rather a "tokenized contract that follows their price".[2] The value of such a token is not inherent; it is a derivative whose worth depends entirely on the solvency and trustworthiness of the centralized issuer—in this case, Robinhood and its custodian. This structure does not eliminate counterparty risk; it merely repackages it in a digital wrapper.

The Operational Shift: How Specific Platforms Benefit from Tokenization

The tokenization movement is not a fringe experiment; it is a core strategic initiative being driven by influential players in global finance. These firms are making a significant operational pivot, becoming global, 24/7 digital asset platforms to create new revenue streams and enhance efficiency.

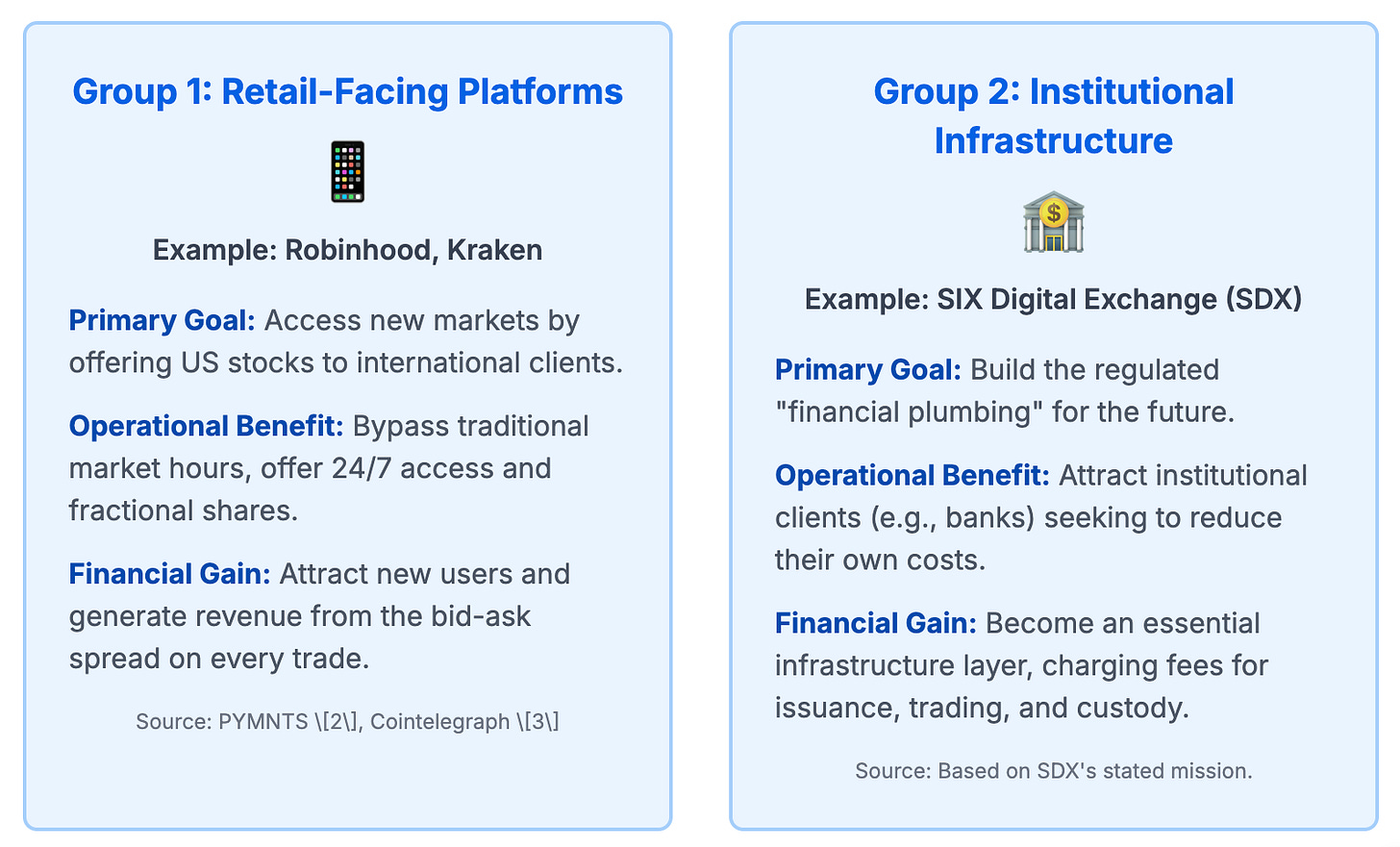

Retail-Facing Platforms (Robinhood & Kraken): For platforms like Robinhood and Kraken, the primary benefit of offering tokenized U.S. stocks is accessing new markets, specifically international clients in regions like Europe.[2, 3] Operationally, this allows them to bypass the constraints of traditional U.S. market hours and offer fractional shares of high-demand stocks around the clock. The financial benefit is direct: they can attract a new user base and generate revenue from the bid-ask spread on every trade executed on their platform. By operating within a "walled garden," they control the entire user experience and capture all associated value.

Institutional Infrastructure Providers (SIX Digital Exchange): For traditional institutions like Switzerland's SIX Digital Exchange (SDX), the benefit is different but equally significant. SDX is not primarily a retail platform; it is building the regulated, institutional-grade infrastructure for a new digital asset ecosystem. By creating a fully regulated digital asset exchange and central securities depository, SDX positions itself as the core plumbing for other major banks and asset managers. Their operational benefit is attracting clients like Citi, who can then use SDX's platform to tokenize assets and reduce their own back-office costs. SDX's financial gain comes from becoming an indispensable, foundational layer in the emerging digital asset market, charging fees for issuance, trading, and custody services.

These examples illustrate that whether the goal is accessing new retail customers or building the foundational infrastructure for institutions, the operational shifts enabled by tokenization are designed to enhance the strategic position and profitability of the implementing firms.

The Underlying Engine: How Tokenization Enhances Profitability

These new operational efficiencies, particularly instant settlement, are not abstract benefits. They directly impact the profitability of the core revenue streams that define modern brokerage models. By reducing risk and back-office costs for market makers and the platforms themselves, tokenization makes the existing business of profiting from user trades more lucrative.

A shift to a tokenized securities infrastructure, with its promise of instantaneous "atomic" settlement, would create significant new efficiencies in the trade lifecycle. Currently, the T+1 settlement cycle introduces risk and ties up capital for market makers.[4] Eliminating this delay by consolidating the clearing, settlement, and custody functions into a single automated layer on a blockchain would dramatically reduce operational costs and risks for these firms. Industry reports estimate that these automations could result in annual savings of up to $20 billion for the capital markets industry.[5]

The central question is who captures this newly created value. The core of the brokerage model is the platform's ability to profit from user trades, either via the bid-ask spread or, in the U.S., through Payment for Order Flow (PFOF).[6] Tokenization makes processing those trades cheaper and less risky for the market maker or the platform itself. This enhances their ability to profit from the spread or to continue participating in the PFOF ecosystem. The fundamental power dynamic remains unchanged; the efficiency gains simply increase the profit margin for the platform and its partners.

For retail-facing platforms like Robinhood and Kraken, tokenization is an operational tool for global market expansion and user acquisition. For institutional players like SIX Digital Exchange, it is a means to build and control the next generation of financial market infrastructure.

In both cases, the efficiency gains from tokenization—particularly instant settlement and reduced back-office costs—are poised to be captured by the platforms and their partners. These operational improvements directly enhance the profitability of their existing business models, whether based on the bid-ask spread or PFOF. While there are ancillary advantages for investors, such as greater access, the primary financial benefits of this technological shift are being realized by the firms that are building and controlling the new tokenized ecosystem.

References

[1] Bank for International Settlements. (2022). Annual Economic Report 2022, Chapter III: The crypto ecosystem and financial stability.

[2] PYMNTS. (2025, July 3). Wall Street Moves On-Chain as Tokenization of US Stocks Goes Global. PYMNTS.com.

[3] Zmudzinski, A. (2025, June 30). Tokenized stock trading live on Kraken, Bybit and Solana's DeFi ecosystem. Cointelegraph.

[4] Depository Trust & Clearing Corporation (DTCC). (2022). The T+1 Implementation Playbook.

[5] Boston Consulting Group & Global Financial Markets Association (GFMA). (2022). The Future of Capital Markets.

[6] Angel, J. J. (2022). Payment for Order Flow and the Retail Investor. Georgetown McDonough School of Business.

Disclaimer

We, Digital Opportunities Group Enterprises, Inc. are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Thanks for reading! Subscribe to this newsletter, our main blog, or both to stay updated and support our work.