Ripple Is Not a Security: Markets Rejoice

Summary

Yesterday a US judge ruled XRP, the cryptocurrency created by Ripple Labs, is not a security (with nuance). This led to a rip in crypto prices, especially in alt-coins (everything except Bitcoin). This likely begins a period of increased regulatory certainty for crypto in the US, something that the industry has been waiting for.

So XRP isn’t a security… unless you’re an early institution

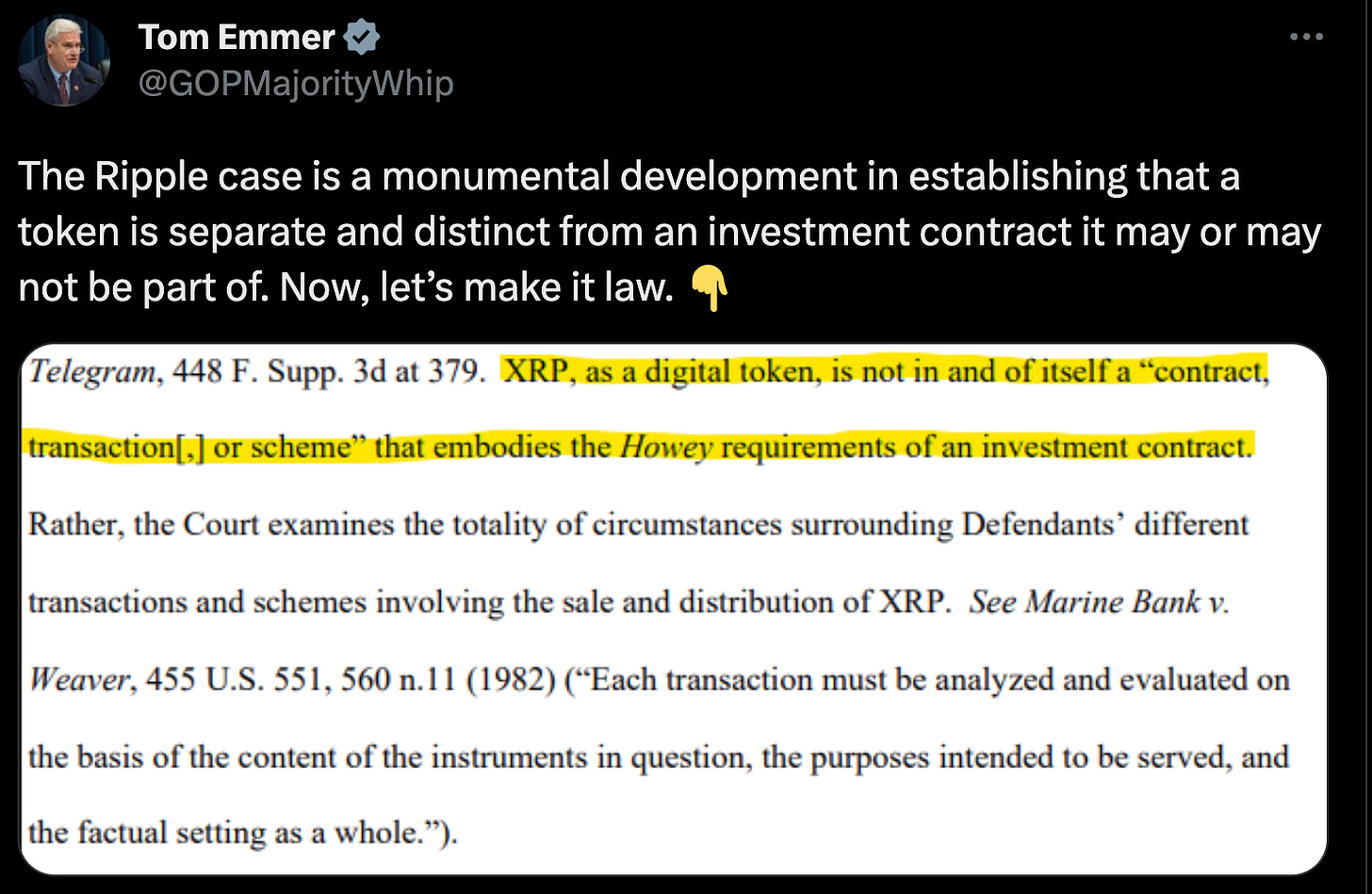

With the SEC breathing down crypto’s neck in the US, the Ripple securities ruling has been heavily anticipated by the market.

Gary Gensler even dodged answering if Ethereum, a crypto blue chip, was a security during an SEC hearing. The posture of the SEC had not instilled confidence in crypto markets, to say the least.

There is nuance to the judge’s ruling though:

XRP sold on exchanges is not a security.

However, XRP sold to institutions in fundraising rounds is deemed an unregistered security.

The ruling was clear though that XRP, the token itself, is not a security.

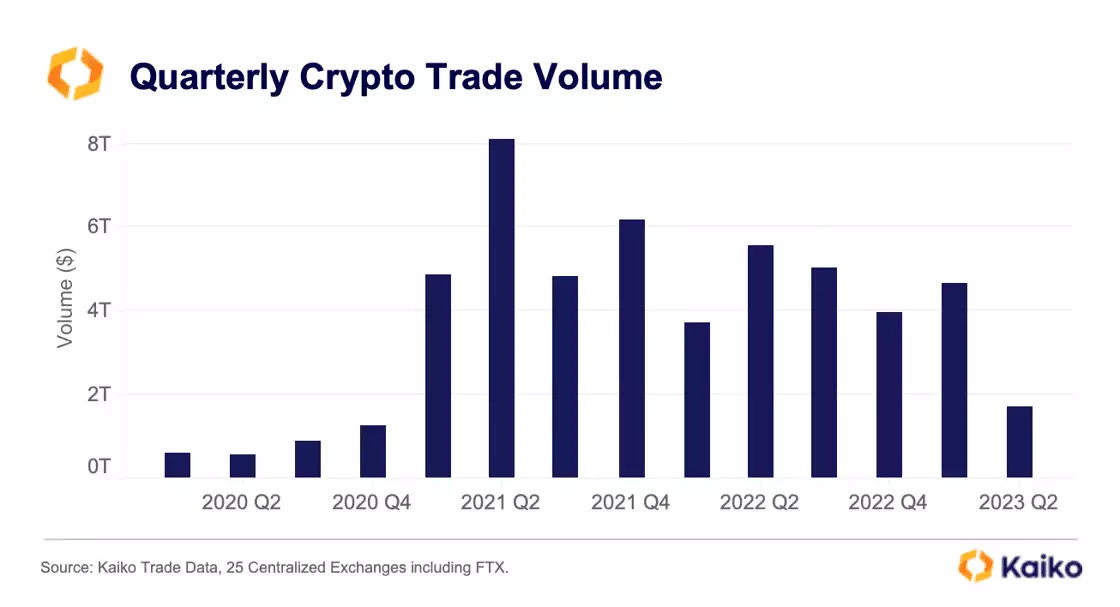

Pre-ruling uncertainty had an impact on crypto markets, especially apparent in volumes. Major market makers even exited or spun down areas of their operation earlier this year. Will this give the confidence for their return? Time will tell.

The market rallies, with alt-coins especially benefitting

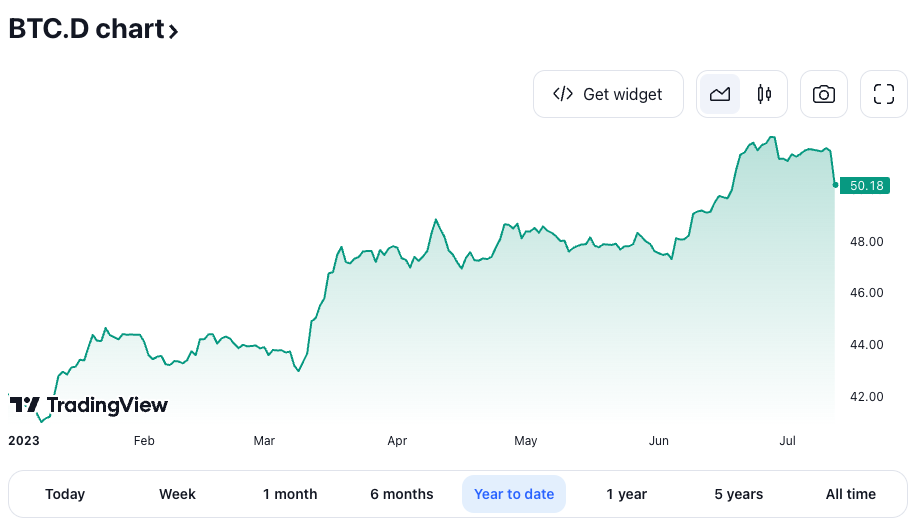

Bitcoin dominance measures the share of Bitcoins market cap relative to the entire crypto market cap. The below chart shows Bitcoin dominance fell after the XRP news, meaning that other cryptos rallied more than Bitcoin. This outperformance of non-Bitcoin cryptos is largely due to market beta, but also the potential for a more certain regulatory environment for cryptos who could have been potentially labeled securities.

But when you zoom out, the relative momentum is still in favor of Bitcoin this year.

This is a big moment for the crypto industry

Over this year, crypto activity has been driven off US soil into jurisdictions offering attractive environments for crypto talent. Excluding potential macroeconomic shocks, this ruling will likely provide a tail wind for cryptocurrency in the US. It will especially be beneficial for developers and those looking to build businesses in the digital assets industry within the country.

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.