Is Ribbon Finance's New Auction System Benefiting DeFi Options Vault (DOV) Users?

Testing the option price efficiency of the Paradigm auction system

For the uninitiated reader, a bit of background on Ribbon and the meaning of a “DOV” is warranted. To quote their introduction documentation directly, “Ribbon Finance is a suite of DeFi protocols that help users access crypto structured products.” A bit further down on the same introduction page, Ribbon defines their Theta Vault DOVs as follows: “Theta Vaults, also known as DOVs (DeFi Options Vaults), were invented by Ribbon in 2021. At its core, a Theta vault is a yield-oriented strategy that proposes that depositors trade volatility on their underlying by selling European options with weekly expiration. The sale value of these options, or "premium," is set through auctions and determines the vault return. The vault reinvests the premiums earned back into the strategy, effectively compounding them for depositors over time.”

About nine months ago, according to Ribbon's auction documentation page, Ribbon switched to a Paradigm auction system from a Gnosis auction system to “achieve more favorable execution for vault depositors”. The page goes on to state that the Paradigm blind auction system increases competition between bidders because the option price clears at the highest bid (among blind bidders) while the Gnosis system cleared at the lowest possible price where demand met supply. As a result, vault depositors (as option writers) should benefit from the relatively higher clearing prices that the Paradigm system should facilitate (increasing vault yields).

In essence, this article attempts to test whether “more favorable execution for vault depositors” (i.e., improved option price efficiency) has indeed occurred on Ribbon since the move to Paradigm auctions. Our definition of option price efficiency (formally defined later in this article) depends on a benchmark of the “efficient”, or “proper”, option price. As our benchmark, we use the price of options traded on the Deribit exchange, an on-chain options trading platform, because it has approximately 90% market share in BTC and ETH options. For some background on the particular topic of option price efficiency, Ribbon wrote an article on June 8, 2022 that analyzed their own auction performance. Based on its date of course, the article only analyzed the performance of the Gnosis auction system.

The focal Ribbon DOV we selected for this article’s analysis is Ribbon’s ETH/USDC put-selling vault. This DOV underwrites ETH put options every week against USDC collateral and has been in operation since at least January 7, 2022.

One approach to determining if Ribbon’s option pricing has improved since the launch of Paradigm auctions is to conduct a simple A/B statistical test. We will compare the price efficiency of options underwritten by the selected DOV during the Gnosis period to the price efficiency of options underwritten by the same DOV during the Paradigm period. To do so, we invoke a two-sample hypothesis test where the null hypothesis could be stated as: the option price efficiency of Gnosis is at least as high as Paradigm. Mathematically we may write the null hypothesis and the implied alternate hypothesis, Ho and Ha, as follows:

where 𝜖 represents option price efficiency and is defined in equations that follow and the symbols G and P differentiate price efficiency of the Gnosis auction system from price efficiency of the Paradigm auction system. The following two equations define the option price efficiency for Gnosis and Paradigm respectively:

where p is option price, i represents the i’th option in the series, D refers to the Deribit exchange, and N are the total number of options from the two groups of auction systems, Gnosis (G) and Paradigm (P). In words, these equations compute the average absolute difference between Gnosis (Paradigm) option prices and prices of the exact same (paired) contract on Deribit.

As stated above, the Deribit price represents our measure of the option’s “proper” price because Deribit maintains a dominant percentage of total open interest on BTC and ETH options (~90%) and hence represents the most efficient price (more so than any other benchmark anyway). Price efficiency of the Gnosis auction system is calculated from options underwritten by the vault when Ribbon used the Gnosis auction system (using equation (3) above) and price efficiency of the Paradigm auction system is calculated from options underwritten by the vault thereafter beginning with the launch of the Paradigm auction system (using equation (4) above).

To demarcate the period of Gnosis auctions from the period of Paradigm auctions for the A/B test, we need to locate the exact Paradigm auction launch date for the chosen DOV. We turned to the smart contract for the selected Ribbon DOV to locate this date. The vault’s smart contract address is 0xCc323557c71C0D1D20a1861Dc69c06C5f3cC9624. By viewing this contract on etherscan from the “Contract” tab, we can see that it is a proxy contract and that two implementation contracts have been created for this proxy contract, as shown below:

We then click the address link next to “the implementation contract” (0x41fDd39De8Ea5530070E1D084c35464Fd37CbD3E) and subsequently click the address link of the creation transaction hash (0x418243ce2d76b625116a2bdbb1fc3d4b5c556613e547dbfa4ddf42ac411cf195). A snapshot of the creation transaction page displays the contract’s creation timestamp, which represents the time after which Ribbon DOVs started using the Paradigm auction system.

Based on the creation timestamp of the implementation contract and since Ribbon DOVs underwrite options every Friday at 0800 UTC, we conclude that the date demarcating the start of Paradigm auctions is the first Friday that follows July 20, 2022, which is July 22, 2022. In other words, starting on July 22, 2022, Ribbon vaults have been underwriting options via Paradigm’s blind auction system and prior to this date the vaults used the Gnosis auction system.

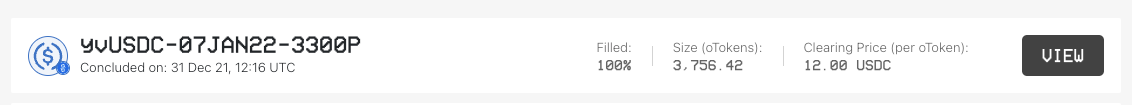

We collected data from the Gnosis period beginning with the option that was underwritten by our selected Ribbon DOV on Dec 31, 2021 at 12:16 UTC, which had a strike price of $3,300 and expired on Jan 7, 2022. The snapshot below captured from Ribbon’s historical auction data page shows the auction information for this option (i.e., the size underwritten in the number of options and its clearing price in Yearn USDC):

Note that our selected DOV also underwrote options on Dec 27, 2021 and Dec 9, 2021, but the sizes of options written for these weeks (shown below) were anomalously small (at less than 3 total options) while in all other weeks much more than 1,000 options were underwritten. Therefore, we excluded these weeks from the Gnosis data.

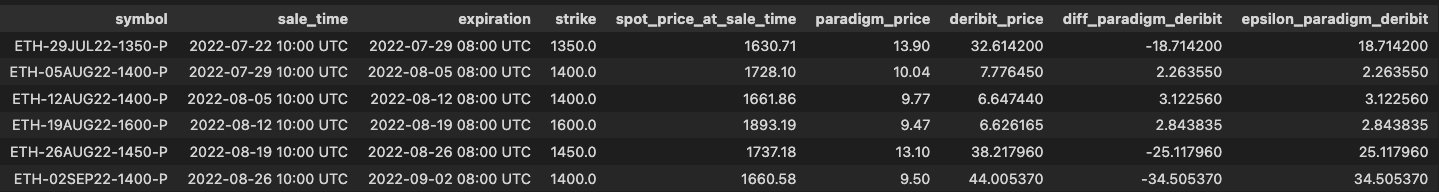

In total, we collected 27 observations from the Gnosis period, which consisted of sale dates beginning Dec 31, 2021 and ending July 15, 2022. A sample of the first 6 observations is shown below:

Differences between Gnosis option prices and Deribit option prices over time are plotted below:

We eliminated no data from the Paradigm period, which consisted of sale dates between July 22, 2022 and April 21, 2023. During this span of time, the selected DOV experienced a single week where it did not write any options, which occurred on March 3, 2023. In total, we collected 39 observations from the Paradigm period. A sample of the first 6 observations is shown below:

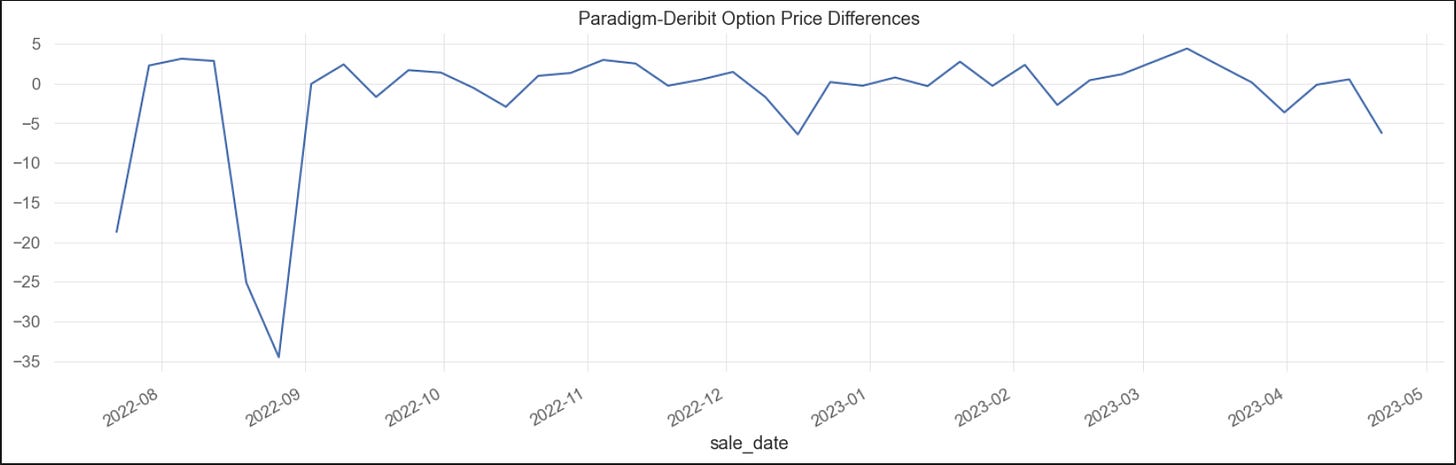

Differences between Paradigm option prices and Deribit option prices over time are plotted below:

Based on the above plots, we could speculate that both Gnosis and Paradigm auction systems perhaps were initially more volatile because auction bidders were still experimenting with their strategies during the first few weeks. Evidently both reached greater stability as time progressed and as market forces matured.

Having collected our two groups of data, we are ready to test the null hypothesis stated above. We selected the Mann-Whitney U Test as our statistical hypothesis test because neither of our two data groups are normally distributed (i.e., they both fail the D'Agostino-Pearson test for normality with p-values less than 1e-11). The Mann-Whitney U Test is a non-parametric statistical test and makes no assumptions about the distribution(s) of underlying datasets. The result of this test, subjected to the hypotheses stated above in equations (1) and (2), produced a p-value of 0.00012, indicating that we can reject the null hypothesis that Gnosis auction price efficiency is greater than or equal to Paradigm auction price efficiency. In other words, the Paradigm auction system is a more efficient option pricing system than Gnosis.

We might also wish to know whether Paradigm’s pricing is significantly different than Deribit’s. Formally, we may state this as a new set of hypotheses, as follows:

In other words, this null hypothesis states that Paradigm’s price efficiency is equal to Deribit’s price efficiency. Again, we use the Mann-Whitney U Test because our dataset from the Paradigm period is not normally distributed. This time we are testing whether the average price difference between Paradigm and Deribit is significantly different than zero. The result of this test produced a p-value of 0.90, indicating that we cannot reject the null hypothesis. In other words, Paradigm’s pricing is indistinguishable from Deribit’s (over enough time).

In summary, we collected option prices from Ribbon’s ETH/USDC put-selling vault from two distinct periods (1) during the Gnosis auction system and (2) during the Paradigm auction system. We also collected option prices from Deribit for the corresponding option contracts underwritten by the vault from around the same sale times because we reasoned that Deribit options are most efficiently priced. To answer whether the option price efficiency of this vault had improved under the Paradigm auction system, we performed a two-sample statistical hypothesis test, which revealed that the Paradigm auction system has improved the vault’s price efficiency over the previous Gnosis auction system. Finally, we performed one last hypothesis test to determine whether Paradigm’s pricing is distinguishable from Deribit’s pricing (again, representing the most efficient pricing system) and concluded that there was no distinguishable difference between the two. Under these findings, we must conclude that the Paradigm blind auction system is indeed superior than the Gnosis auction system when it comes to price efficiency.

A future analysis might repeat these statistical tests under a larger sample of data (e.g., from multiple DOVs instead of only one) and perhaps under stricter conditions (e.g., removing outliers if appropriately justified).

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process.

We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.