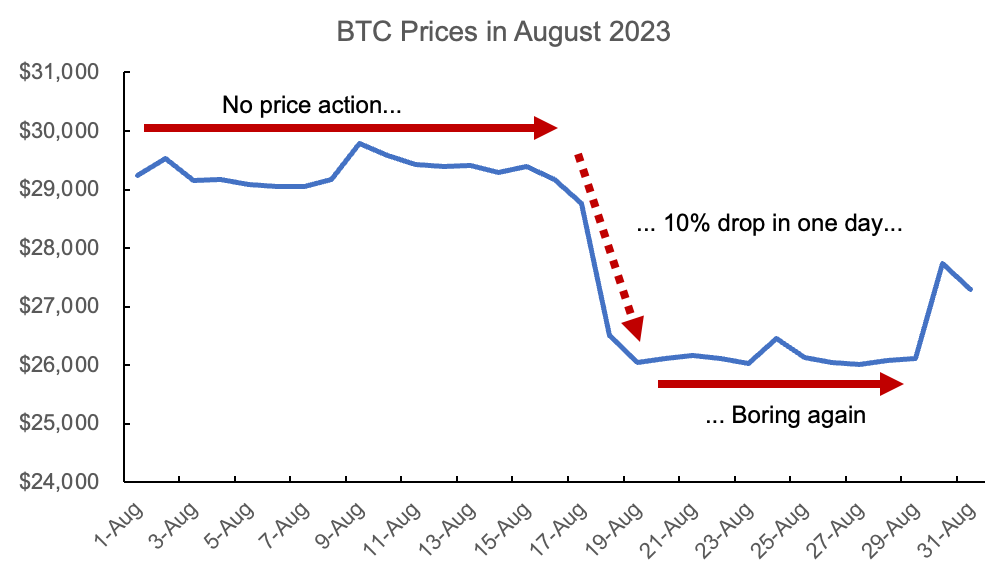

August crypto market action was a good representation of the rest of the year. Prices did a whole lot of nothing mostly, then were punctuated with abrupt, violent moves and whipsaw action.

Our current market is made possible by two core variables: massively declining volume and volatility screaming lower.

Lower volume means less liquidity to buffer trading activity. Persistent declines in volatility leads to more traders loading up into short volatility positions. In fact, during the sharp -10% decline in Bitcoin prices, there were over $1 billion in liquidations that occurred related to options (volatility) positions on OKX and Deribit.

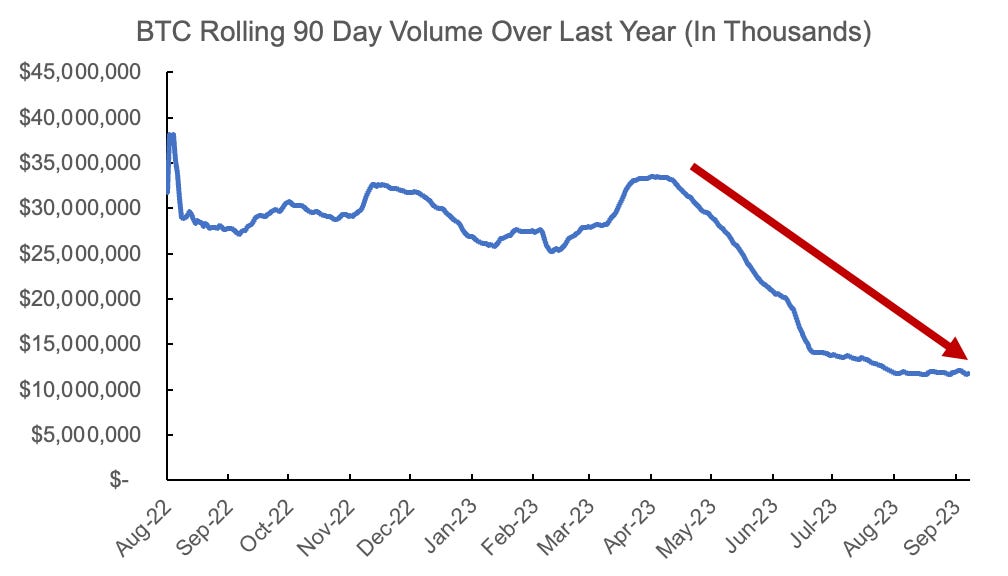

Volumes Declining as Activity Dries Up

Zooming out to take a look at Bitcoin trading volume over the last year, we can see current volumes are down by around -70% from peak. Undoubtedly, retail trading has declined. This has begotten even lower volumes as lower retail activity (plus regulatory uncertainty earlier in 2023) has created a worse environment for market makers. In May there were headlines that some crypto market makers began scaling back their trading operations, specifically in the US.

Volatility Has Been Falling Off a Cliff

Recent, persistent declines in volatility have made it unprofitable for market participants to position themselves for large price swings. As mentioned earlier, the August market crash was exacerbated by short volatility related selling.

Below is the Bitcoin Volmex Implied Volatility Index (BVIV) over the last year. This is an index that measures the volatility implied by Bitcoin options markets. Short volatility has been a great trade as volatility continues to decline.

Below is a screenshot from Ribbon Finance for their ETH put selling vault. This is an on-chain structured product that systematically sells weekly ETH puts.

If we use this as a proxy for the profitability of some short options market participants, they have been doing well since June 2022. However, performance going further back is dismal.

Short vol is great… until it isn’t.

Other Noteworthy Headlines

Fidelity Note on Ethereum Investment Thesis

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Very insightful, thank you Phillip!