Crypto Market Update Post JPY Liquidity Crunch

From August 2024 "DigOpp Student of Crypto" Overview

Global risk assets took a plunge due to The Japanese Central Bank raising rates. Crypto was not excluded from this downside market action. Here are some charts summarizing crypto market dynamics from a review we put together in our “Student of Crypto” document.

Bitcoin Drawdown Among Worst in Recent History

Bitcoin’s intraday peak to trough drawdown, of -18%, during the JPY liquidity crunch was the 95th percentile worst daily drawdown since 2020

August 5 Derivative Liquidations Highest YTD

Perpetual swaps are the primary derivative utilized in cryptocurrency markets. Liquidations of derivatives totaled $209M, the largest this year.

BTC Implied Volatilities Explode Higher, Then Quickly Settle

Bitcoin implied volatility, as measured by BVIV index, ripped to nearly 100. It later settled in the mid 60s.

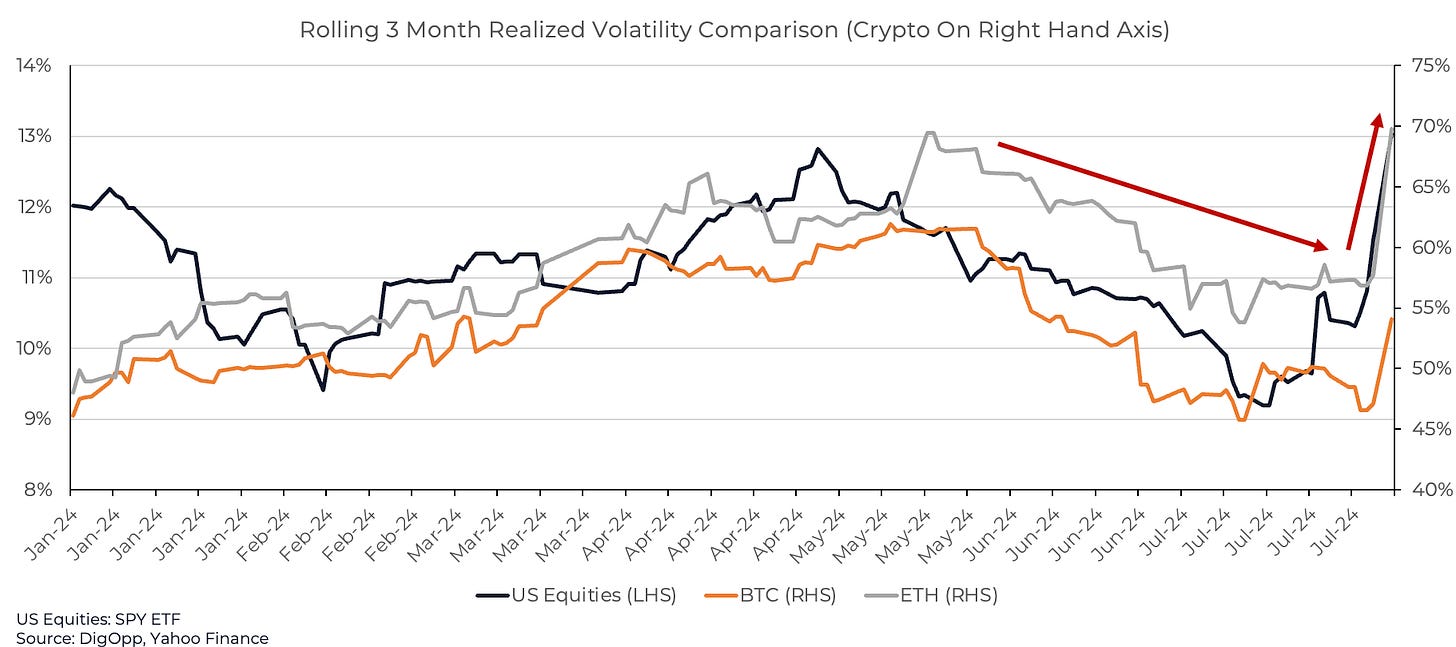

Realized Volatility Spiked With ETH Spiking More than BTC

After a few months of declining volatility, this recent event saw a huge spike.

Exchange Volumes Spiking

Until the JPY event exchange volumes, along with volatility, had been on a decline since Q1 2024.

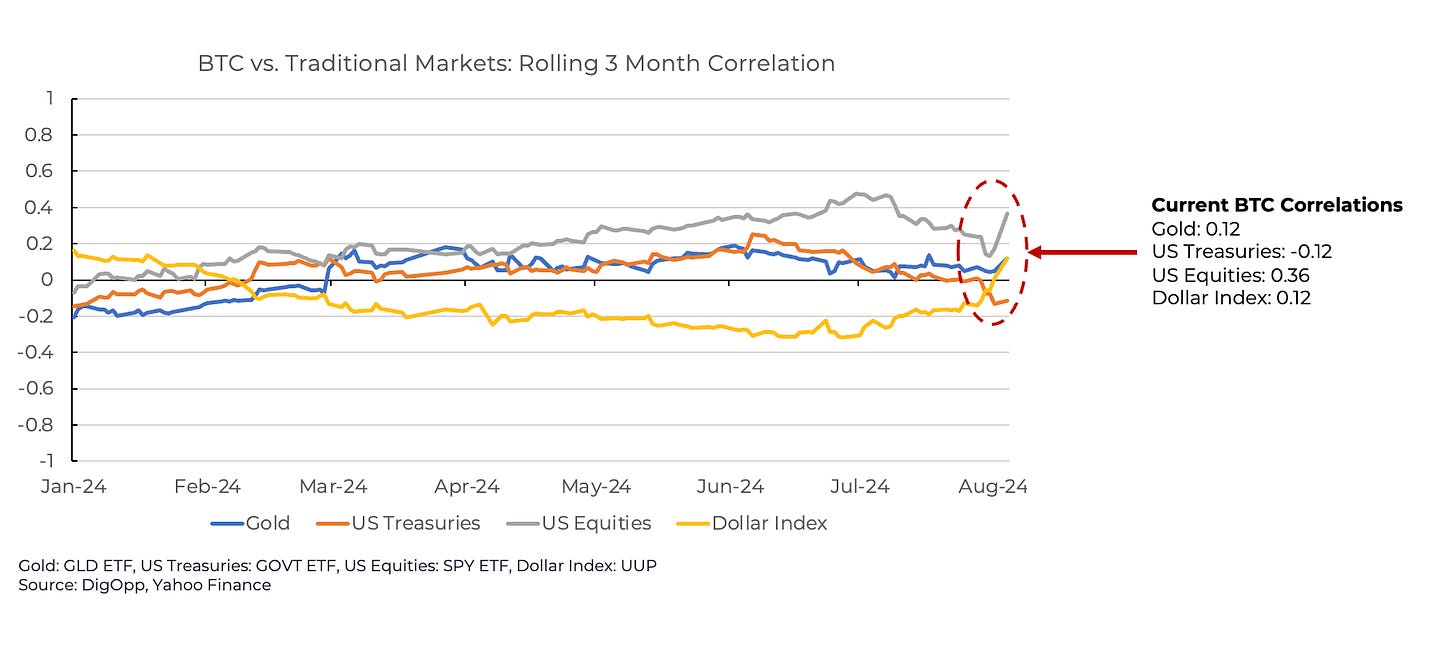

BTC Vs. Market Index Correlations Increased, but Low Overall

As would be expected in a liquidity event, Bitcoin’s correlation to assets affected by deflationary shocks increased. However, the correlation overall is still relatively low.

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.