Tokenized money market funds are the talk of the town at the moment. I’ve been asked numerous times what I think of various tokenized cash alternatives. So we did some digging.

In this article we take a look at 37 tokenized money market products along some key dimensions. Our objective is to provide you with a simple starting framework for thinking about what is important in these products as you consider integrating them into your operation and conducting further due diligence.

We take a look at the following dimensions:

Permissions-Investments Matrix - a quick way to gauge offerings by investment and token features.

Restricted Jurisdictions - especially important for US based investors.

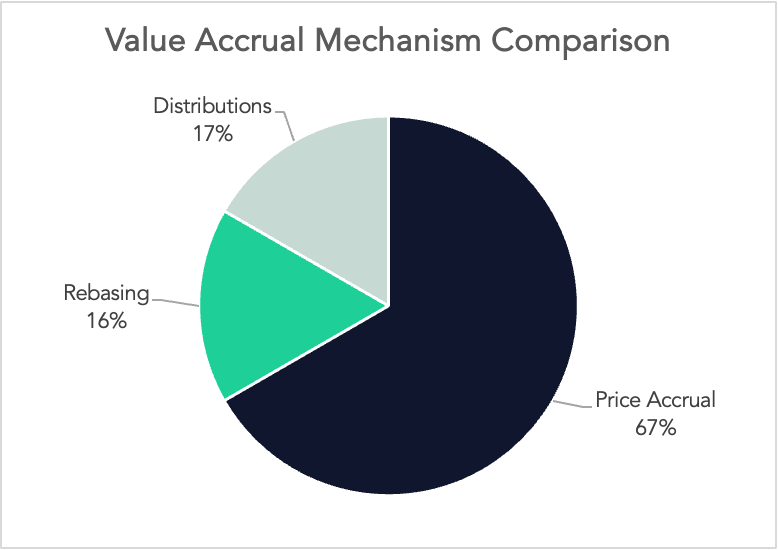

Value Accrual Mechanisms - how yields are accrued to the token holders and their operational implications.

Counterparty Catalogue Series

This article is a part of a series of articles for Counterparty Catalogue, a platform we’ve built as a due diligence and market discovery tool for investors in digital assets who are evaluating service providers and solutions.

The Universe

First we can take a look at the universe of products out there.

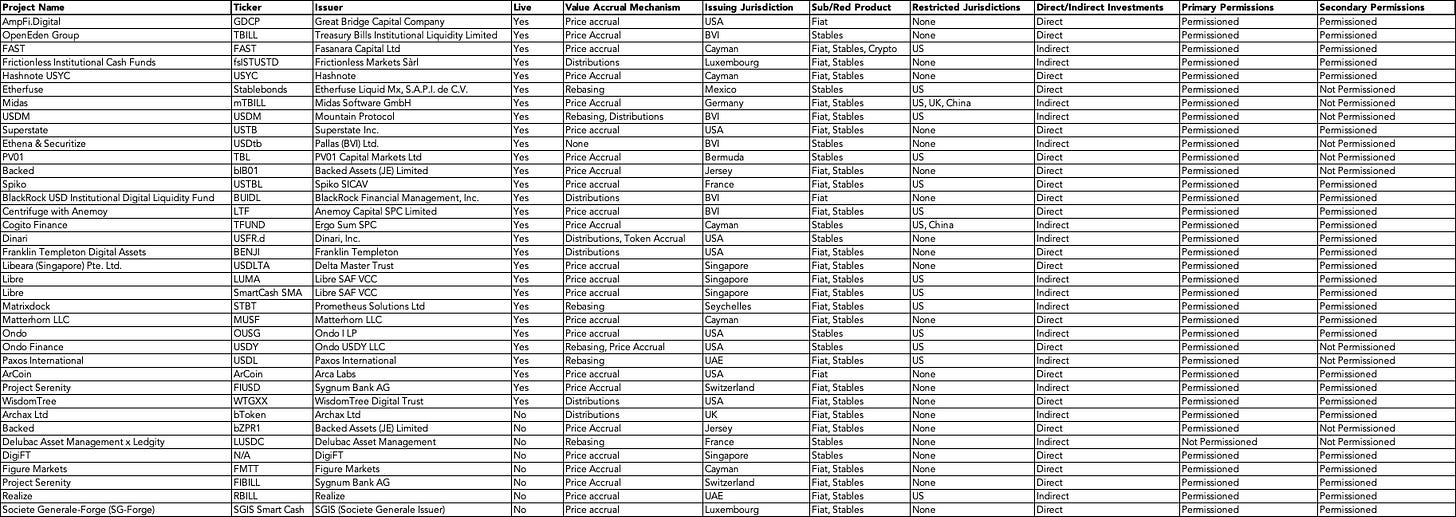

There is a table with more details here (this table has info on fees, holdings, and more), but for this article we trim the fields down to make it more readable in this format (additionally you can see more on Counterparty Catalogue)… even with the trimmed fields, this table is a bit too much to look at in an article. You can scroll past this table to the dimension analyses if you like.

The underlying holdings are largely <1 year maturity fixed income products (e.g., reverse repo, corporate paper, t-bills)… it may be more accurate to call these products “tokenized cash alternatives”.

Edits:

Jan 22, 2025 - FAST token updated as Live

Here is a description of the fields.

Ticker: the token ticker symbol.

Issuer: issuing entity name.

Live: is the product currently live?

Value Accrual Mechanism: how does value accrue to the token?

Rebasing: the yield is contributed by distributing more tokens to users. Usually the token will be pegged to $1. If you own 1 token (representing $1) and you accrue 3% of yield, then your digital asset wallet is distributed another 0.03 tokens for a total of 1.03.

Price accrual: the yield is accrued to the token value. So if the token is worth $1 and then accrues 3% yield, then the new token value will be $1.03.

Distributions: the yield can be “harvested” and distributed usually in the form of stablecoins or another token.

Issuing jurisdiction: the jurisdiction the token is issued from, which will affect relevant securities laws.

Sub/Red products: subscription and redemption products - i.e., what can you use to subscribe and redeem from the token? Examples are fiat USD, or a stablecoin like USDC.

Restricted jurisdictions: is holding the token in a certain jurisdiction restricted? The US is a common restricted jurisdiction.

Direct/Indirect investments: does the token represent ownership of a vehicle directly managed/sub advised by the issuing entity or a closely related entity?

Primary permissions: are there permissions on the creation (i.e., subscription and redemption of the token)? Typically there is a KYC process to subscribe and redeem. The subscription and creation of tokens is also commonly referred to as “minting”.

Secondary permissions: are there permissions required for secondary market transactions. A secondary market transaction could be providing the token as collateral, trading/swapping the token. If there are secondary market permissions, then there is usually KYC required for all participants in secondary markets.

Which One Is Right For Me?

37 tokens is enough of a universe to be decently overwhelming. Let’s talk about a few dimensions to evaluate these products, so you can understand what features may be right for your operation.

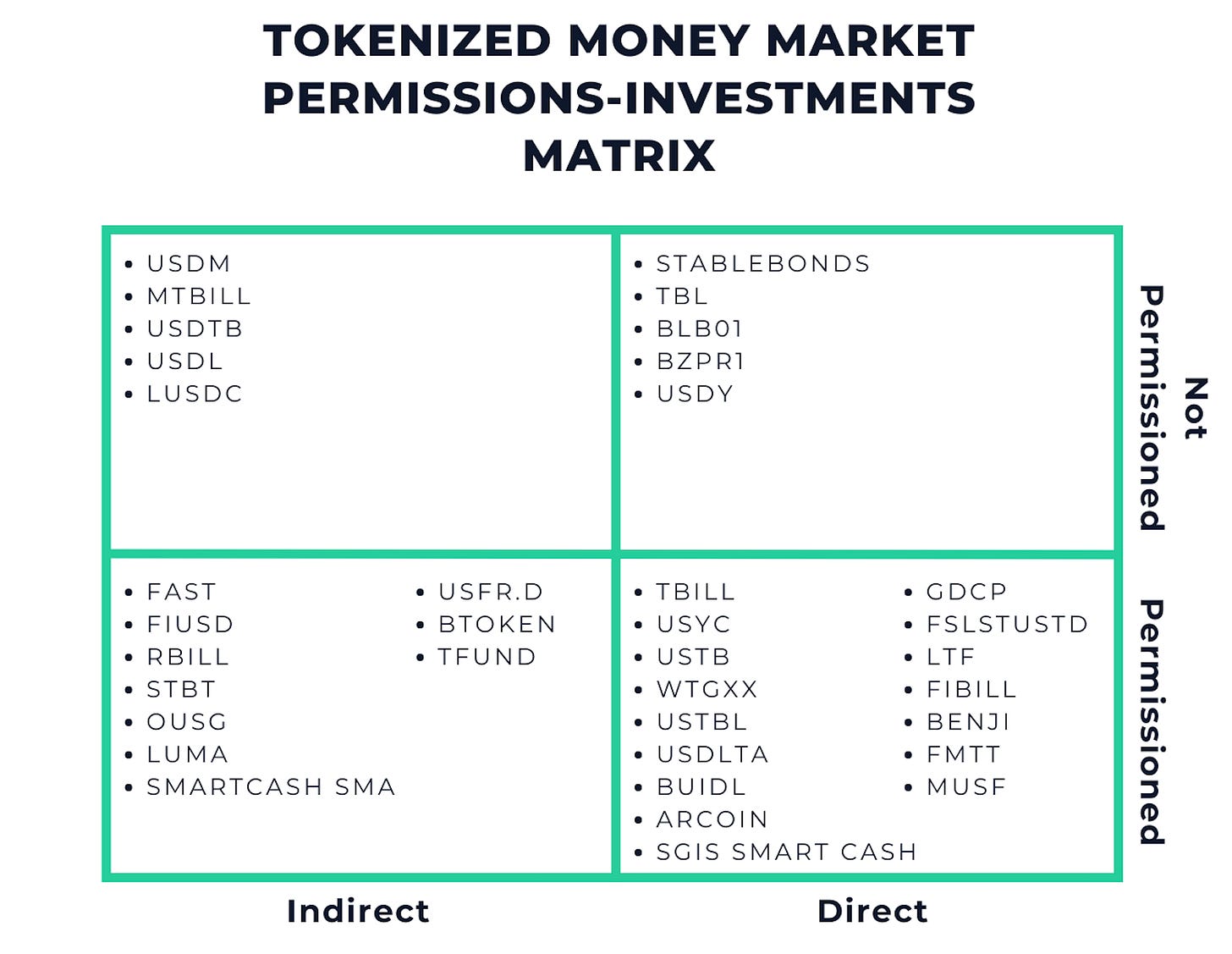

Permissions-Investments Matrix

Permissions-Investments Matrix. What is it?

This matrix evaluates tokenized money markets on (1) how they handle (or don’t handle) KYC/AML in secondary markets (permissioned vs. not permissioned), and (2) whether the token issuer directly or indirectly manages the underlying assets (i.e., another asset manager or sub-advisor manages the underlying holdings).

Why does this matter?

Compliance & Liquidity: Permissioned tokens meet require KYC for all parties involved in transacting the token - probably a better fit for an institution with strict requirements. Non-permissioned tokens are easier to trade and use as collateral in DeFi (if they have been integrated with a DeFi protocol) - these may be the better fit for funds who need near instant liquidity.

Operational Due Diligence: Whether the underlying assets are directly or indirectly managed informs the due diligence path required and can involve multiple parties if indirect. Indirect solutions may also have additional layers of fees, but the ultimate manager of the underlying may have a strong brand name (the underlying could be an established money market ETF for example).

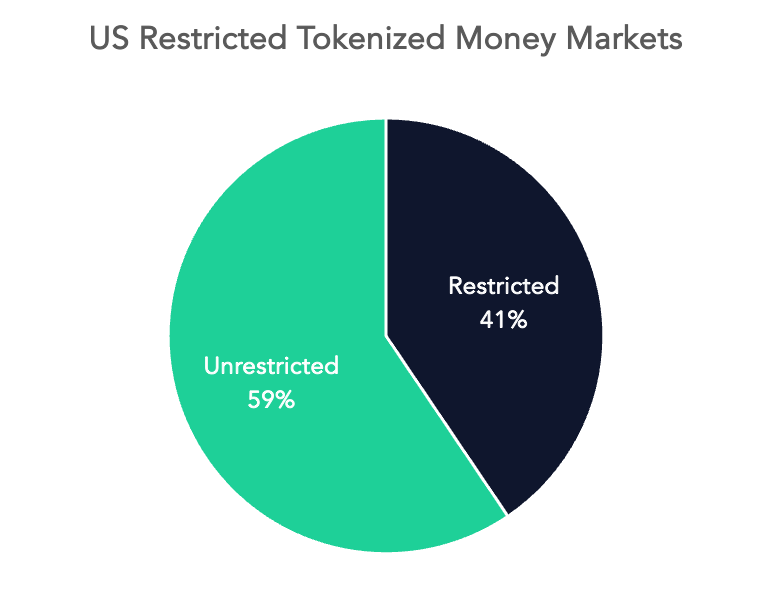

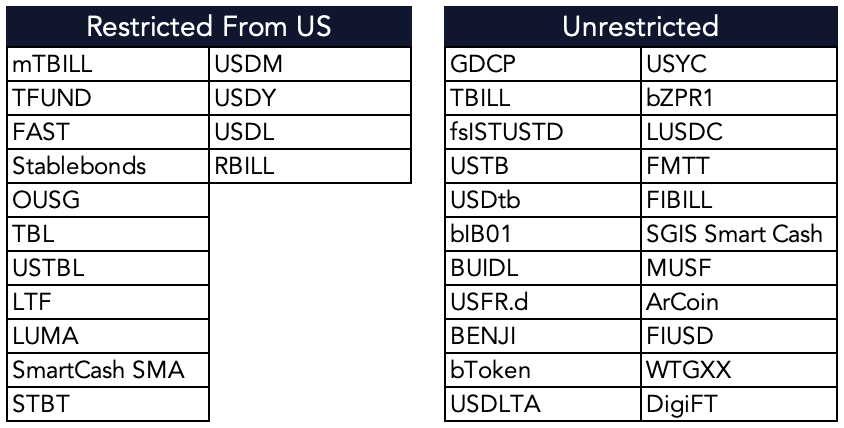

Restricted Jurisdictions (*Cough* USA)

US regulators are a problem for operating in digital assets. It is not uncommon for a crypto product to be restricted from US investors.

In fact, 41% of these tokenized cash alternatives are restricted from US investors. There are a couple of UK and China restricted honorable mentions, but the US is the main one to worry about.

Value Accrual Mechanism

The final dimension we’ll look at is the method by which the yield accrues to the token holder. This can be done in three ways, which we went over earlier. But here they are again, so you don’t have to scroll:

Rebasing: the yield is contributed by distributing more tokens to users. Usually the token will be pegged to $1. If you own 1 token (representing $1) and you accrue 3% of yield, then your digital asset wallet is distributed another 0.03 tokens for a total of 1.03.

Price accrual: the yield is accrued to the token value. So if the token is worth $1 and then accrues 3% yield, then the new token value will be $1.03.

Distributions: the yield can be “harvested” and distributed usually in the form of stablecoins or another token.

What are the advantages of each:

Price accrual is the obvious favorite, with 67% of tokens using this mechanism. This mechanism has a couple of advantages, (1) it is likely more tax efficient as the asset value grows rather than receiving yield “dividends”, and (2) it can also be more efficient in DeFi in AMMs (Automated Market Makers) and as collateral in lending pools as there is no added complexity of dealing with harvesting yields while the asset is deployed.

Distributions and rebasing are fairly similar mechanisms. The advantage of these is that the underlying token can maintain a value of $1 (where price accrual cannot), so this can have advantages where it is important that the underlying maintain its value.

Counterparty Catalogue

Counterparty Catalogue is a market intelligence and operational due diligence (ODD) platform built for digital assets investors. Over our time operating in the space, we have found there is a need for ODD from practitioners who have had boots on the ground in this asset class. Because of material nuances of crypto trading operations, you cannot directly port over an ODD framework from traditional finance to this asset class. Counterparty Catalogue extends purpose built ODD frameworks and insights for digital assets counterparties and service providers.

If you’re already active in digital assets and looking for an ODD resource—or if you’re exploring the field and need a deeper understanding of crypto trading operations—feel free to reach out. Counterparty Catalogue was created with you in mind.

We have partnered with various service providers to perform thorough ODD of their offering (e.g., custodians, custody technology, prime brokers). You can access these reports where available by requesting them on the platform. If there is a provider you are interested in evaluating, we can also perform custom requests.

Disclaimer

We, Digital Opportunities Group Enterprises Inc., are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.