Choosing the right prime broker (PB) in the digital asset space can be overwhelming. In traditional finance (TradFi), PBs typically offer a broader range of services across multiple asset classes. In crypto, PBs often specialize in more specific areas such as lending, multi-exchange access, introductions to allocators, over the counter (OTC) pricing, and more. As the industry matures, PB offerings continue to expand. And with so many options available, finding the best fit depends on your specific needs.

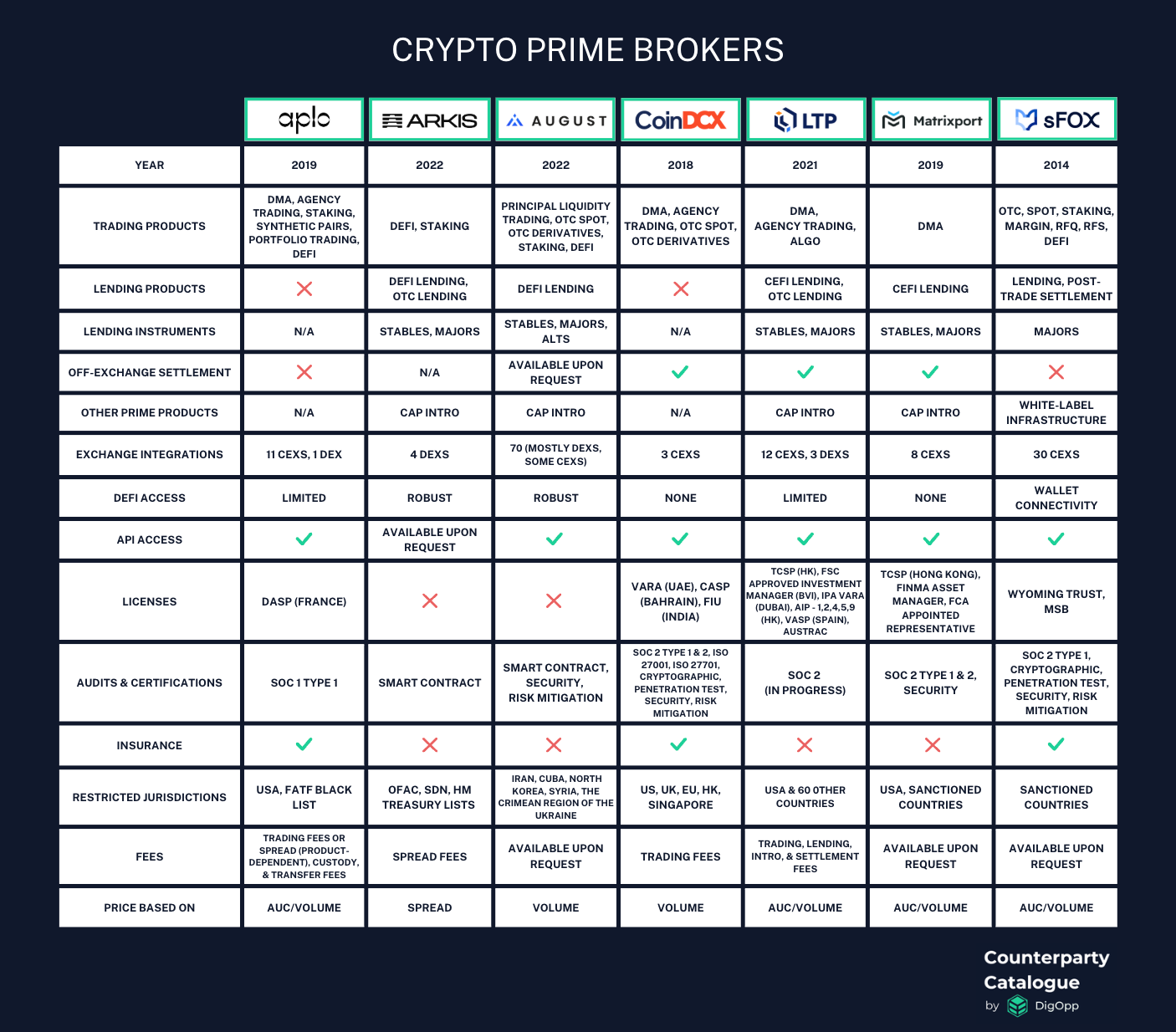

This year, we’re releasing comparison articles on all types of counterparties in the digital asset industry. In this article, we focus on PB solutions - breaking down their core offerings and highlighting the features that matter most. To simplify your decision making, we’ve created a detailed comparison table of the solutions featured on our platform, Counterparty Catalogue. Think of this as your cheat sheet - a side-by-side view of featured PBs to help you navigate your options and find the best fit for your needs.

The information in this table has been provided directly by the counterparties and/or sourced from their publicly available materials, including websites and other resources. We have not independently verified all details, including the quality of the audits listed. A full Operational Due Diligence (ODD) assessment would be required for complete verification - please reach out for assistance in evaluating these entities.

This table is for informational purposes only and should not be interpreted as an endorsement or assessment of any counterparty’s risk or reliability. Counterparty details may change over time, and we recommend verifying information with the respective companies before making any decisions.

Legend:

Year: The year the company launched.

Trading Products: Financial instruments and services offered for buying, selling, and managing crypto assets.

DMA: Direct Market Access (DMA) allows direct access to exchanges.

Agency Trading: Enables clients to trade across multiple exchanges through a single interface.

Staking: The process of locking up assets to earn rewards on proof-of-stake networks and DeFi protocols.

Synthetic Pairs: Derivatives-based trading pairs without holding the underlying asset.

Portfolio Trading: The ability to trade multiple assets as a single transaction, optimizing execution and reducing costs, often used for portfolio rebalancing or large trades.

Principal Liquidity Trading: A trading model where the vendor uses its own balance sheet to provide liquidity, acting as the direct counterparty instead of just facilitating trades.

OTC Spot: Off-exchange private trades at market prices, ideal for large orders.

OTC Derivatives: Custom off-exchange contracts (e.g., options, swaps) for hedging and leverage.

DeFi: On-chain trading and financial services executed through smart contracts without intermediaries.

Margin: Trading with borrowed funds provided by the broker to increase position size.

RFQ: Request for Quote (RFQ) trading is a method where a trader requests a price quote from a liquidity provider for a specific trade, receiving a one-time quote that can be accepted or rejected.

RFS: Request for Stream (RFS) trading is a method where a liquidity provider streams continuous price updates to a trader, allowing for real-time execution rather than a single fixed quote.

Lending Products: Services that allow users to borrow or lend crypto assets.

DeFi Lending: Borrowing via smart contracts without intermediaries.

CeFi Lending: Custodial lending facilitated by centralized platforms.

OTC Lending: Privately negotiated crypto loans with flexible terms.

Post-Trade Settlement: A structured process that enables efficient capital deployment, delayed settlement, and risk management for clients.

Lending Instruments: The types of assets available for lending and borrowing. More details about each counterparty’s specific lending instruments can be found in their profile on Counterparty Catalogue.

Stables: Stablecoins (e.g., USDT, USDC) pegged to fiat currency.

Majors: BTC, ETH, and wrapped versions (e.g., WBTC, cbBTC, WETH).

Alts: Altcoins (Alts) are all other cryptos (e.g., Layer 1s, DeFi tokens, memecoins).

Off-Exchange Settlement: Allows users to trade on exchange while keeping their assets locked off of the exchange, mitigating exchange-related risks. More details about each counterparty’s specific off-exchange settlement integrations can be found in their profile on Counterparty Catalogue.

Available Upon Request: Feature is provided based on client request and may require additional approval or setup.

Other Prime Products: Additional prime brokerage services beyond trading and lending.

Cap Intro: Capital Introduction (Cap Intro) is a service that connects institutional investors with fund managers to facilitate capital raising and investment opportunities.

White-Label Infrastructure: API-based solution enabling businesses to integrate trading, custody, staking, compliance, and fiat on/off ramps into their platform without building in-house infrastructure.

Exchange Integrations: The exchanges where clients can connect their assets to for trading. More details about each counterparty’s specific exchange integrations can be found on their profile in Counterparty Catalogue.

CEXs: Centralized Exchanges (CEXs)

DEXs: Decentralized Exchanges (DEXs)

DeFi Access: The ability to interact with DeFi protocols.

None: No access to DeFi protocols or on-chain trading.

Wallet Connectivity: Ability to connect wallets to external DeFi platforms.

Limited: Restricted DeFi access, typically limited to select protocols (e.g., Uniswap, DyDx) or specific trading/lending functions.

Robust: Broad and actively expanding DeFi access, including multiple protocols with a focus on rapid integrations and comprehensive on-chain execution.

API Access: Ability to connect through Application Program Interface (API) for automation and integration with other systems.

Available Upon Request: Feature is provided based on client request and may require additional approval or setup.

Licenses: Regulatory approvals or registrations that allow a firm to legally operate in specific jurisdictions.

DASP: Digital Asset Service Provider license (France)

TCSP: Trust and Company Service Provider license (Hong Kong)

FSC Approved Investment Manager: Approved Investment Manager license issued by BVI Financial Services Commission (British Virgin Islands)

VARA: Full Virtual Assets Regulatory Authority license (UAE)

IPA VARA: In-Principle Approval under the Virtual Assets Regulatory Authority (Dubai)

AIP - 1,2,4,5,9: Approval-in-Principle for Securities and Futures Commission licenses (Hong Kong)

CASP: Crypto Asset Service Provider license under the Central Bank of Bahrain (Bahrain)

FIU: Registration under the Financial Intelligence Unit (India)

VASP: Virtual Asset Service Provider license (Europe)

AUSTRAC: AML/CTF registration (Australia)

FINMA Asset Manager: Asset Manager license under the Swiss Financial Market Supervisory Authority (Switzerland)

FCA Appointed Representative: Regulatory status under the Financial Conduct Authority (UK)

Wyoming Trust: Wyoming Trust company license under the Wyoming Division of Banking (USA)

MSB: Money Services Business appointment from Financial Crimes Enforcement Network (FinCEN) (USA)

Audits & Certifications: Independent assessments and approvals that help verify a platform’s security, compliance, and adherence to industry standards and best practices.

SOC 1 Type 1 & 2, SOC 2 Type 1 & 2: Audits assessing operational and security controls.

ISO 27001, 27701: International Organization for Standardization (ISO) 27001 focuses on information security management, and ISO 27701 on privacy information management.

Smart Contract: Security review of blockchain-based smart contracts to identify vulnerabilities and ensure correct execution.

Security: Comprehensive assessment of a platform’s infrastructure, code, and processes to evaluate cybersecurity risks.

Risk Mitigation: Evaluation of a firm’s risk controls and frameworks to assess how effectively it reduces financial and operational risks.

Cryptographic: Analysis of cryptographic implementations to verify encryption strength, key management, and data security.

Penetration Test: Simulated cyberattack to assess system vulnerabilities, exploitability, and overall security posture.

In Progress: Should be completed by Q3 of this year.

Insurance: Counterparties may have various types of insurance to mitigate risks and protect assets against unexpected events. Coverages can include: Technology Errors & Omissions (E&O), Cyber, Crime, Specie, Network Security and Privacy, Professional E&O, Directors & Officers (D&O), General Liability, and Umbrella (or Excess) Liability. More details about each counterparty’s specific coverages can be found in their profile on Counterparty Catalogue.

Restricted Jurisdictions: Countries where services cannot be offered due to sanctions or regulations.

FATF: Financial Action Task Force sanctions list.

OFAC: Office of Foreign Assets Control (OFAC) sanctions list, maintained by the U.S. Treasury Department.

SDN: Specially Designated Nationals list, a subset of OFAC sanctions.

HM Treasury: The UK’s financial sanctions list, maintained by His Majesty’s Treasury.

Sanctioned Countries: The countries restricted under OFAC and other global or regional sanctions lists.

60 Other Countries: Reach out to LTP for a complete list of restricted jurisdictions.

Fees: Categories of fees users may incur for services.

Available Upon Request: The prime broker did not share their fees with us.

Pricing Based On: Pricing models typically scale with factors such as Assets Under Custody (AUC), transaction volume, subscription levels, or specific features.

I hope these comparisons give you a clearer picture of the crypto prime brokerage landscape for 2025. To dive deeper into each solution and its features, be sure to explore their profiles on Counterparty Catalogue.

What’s New on Counterparty Catalogue:

ODD Reports: We recently released an Operational Due Diligence (ODD) report on Dfns, which users can request access to in their profile. Stay tuned on Counterparty Catalogue for more reports!

Reputation Ratings & Reviews: Users can rate and review service providers anonymously based on their experiences.

If you’re looking for ODD on specific digital asset service providers or funds, want to participate in our comparisons, or are interested in CryptoCurrency Security Standard (CCSS) audits, feel free to reach out to us at info@digopp.group.

Disclaimer

We, Digital Opportunities Group Enterprises, Inc. are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.