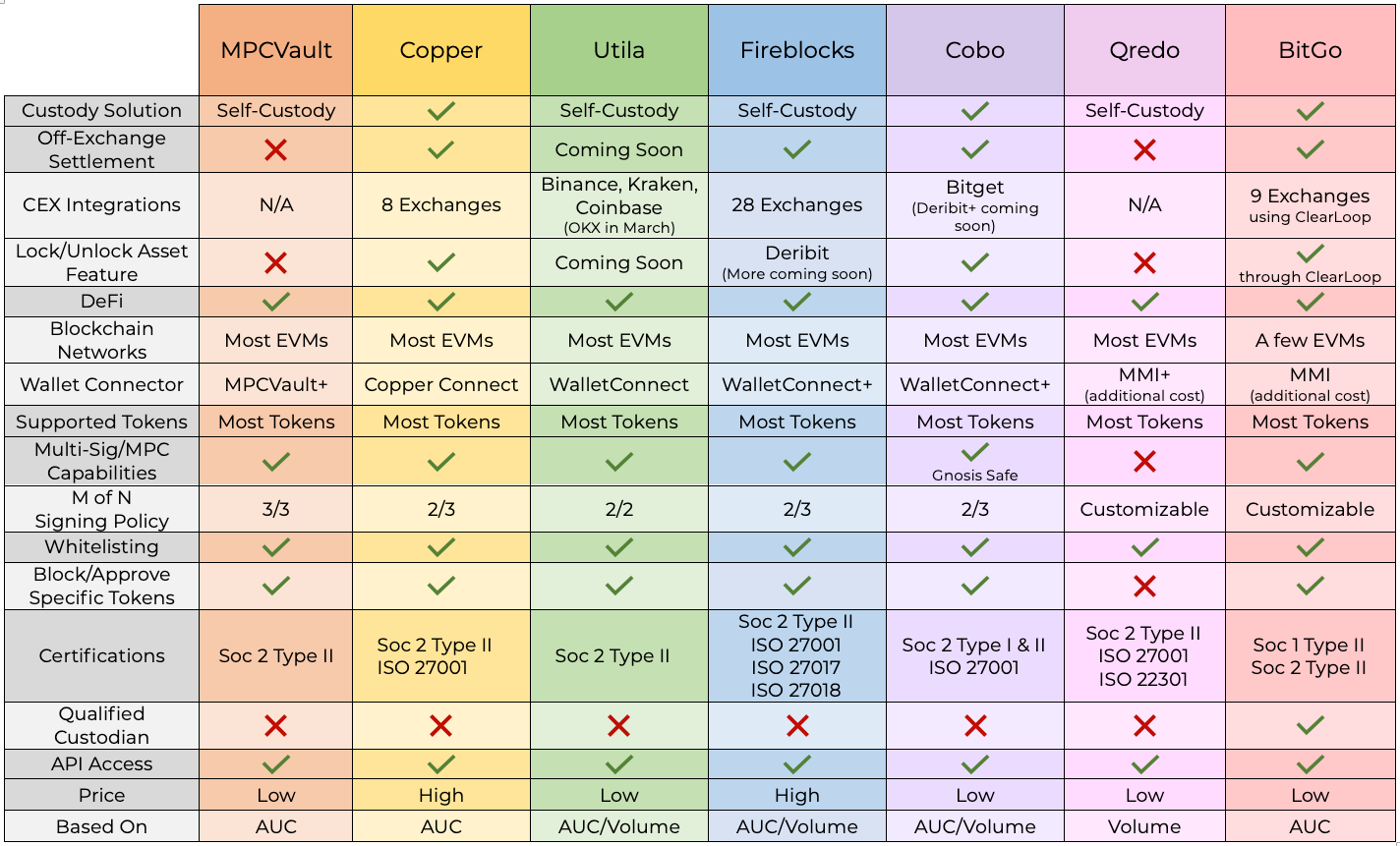

In the rapidly evolving world of crypto, choosing the right custody and off-exchange settlement provider is crucial. After interviewing multiple providers, I quickly realized there’s a lot of solid competition, with the final decision boiling down to pricing and brand reputation. While I couldn’t dig into every provider out there (like Coinbase, HexTrust, and Liminal), my research was driven by our own need to evaluate potential changes in our service providers. After weeks of extensive research, I'm gifting my vast wealth of information to you in an easy-to-understand comparison table. This resource is designed to simplify your navigation in this complex space and help you make well-informed decisions regarding your crypto custody solutions.

Legend:

Custody Solution: Clients can store assets on the platform. Self-Custody means clients control their own private keys and, therefore, their assets.

Off-Exchange Settlement: Ability for clients to connect to exchanges and initiate and settle transactions directly in the platform.

CEX Integrations: Number of Centralized Exchanges (CEXs) clients can connect their assets to and trade.

Lock/Unlock Asset Feature: Products like Copper (ClearLoop) and Cobo (SuperLoop) enable clients to trade on CEXs while keeping their assets locked off of the exchange, mitigating risk.

DeFi: Ability to conduct on-chain transactions.

Blockchain Networks: Decentralized digital ledgers that support various cryptocurrencies and applications. Compatibility with Ethereum Virtual Machines (EVMs) permits interaction with Ethereum and other compatible blockchains.

Wallet Connector: Service used to connect client wallets to the platform. Some wallet connectors, like MetaMask Institutional (MMI), charge a fee.

Supported Tokens: Refers to the variety of digital assets that clients can trade on the platform, encompassing a wide range of cryptocurrencies from various blockchain layers (Layer 1s – base blockchains and Layer 2s – networks built on top of base blockchains for enhanced scalability and efficiency).

Multi-Sig/MPC Capabilities: Multi-sig wallets require multiple signors to authorize each transaction. Multi-Party Computation (MPC) is similar, but operates differently using shards of data that collectively represent a final private key, rather than multiple distinct keys. Both methods enhance security.

M of N Signing Policy: M of N refers to a policy requiring transaction approval from M out of N designated signatories. The ratios listed in the table are the number of approvals or devices required to sign each transaction.

Whitelisting: Allows for interactions with only pre-approved addresses by the client, reducing the risk of fraud and unauthorized access.

Block/Approve Specific Tokens: Clients can manage permissions at the asset level by whitelisting specific assets (not just addresses) for finer control over their holdings.

Certifications: Approvals that the platform holds, indicating the platform’s adherence to industry standards and best practices for security and privacy. Soc 2 Type I and Soc 2 Type II are audits assessing operational controls. International Organization for Standardization (ISO) 27001 focuses on information security management, ISO 27017 on cloud security, ISO 27018 on privacy protection, and ISO 22301 on business continuity.

Qualified Custodian: Entity meets specific U.S. regulatory requirements to safely hold client assets and keys/shards.

API Access: Has the ability to connect through Application Program Interface (API), which is important for automation and integration with other systems.

Price: Monthly fees range from hundreds to thousands of dollars, varying based on the client’s needs.

Based On: Pricing models typically scale according to the client’s Assets Under Custody (AUC) or transaction volume.

+: And more/other options.

Coming Soon: Will be available this year.

Customizable: Client can select their preferred permissions/governance.

I hope this comparison gives you a clearer picture of the crypto custody scene for 2024. We’d love to hear any thoughts or experiences you’ve had, so please share in the comments below.

Disclaimer

We, Digital Opportunities Group, LLC, are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.