Mapping a Crypto Operation

Digital assets operate fundamentally differently from traditional financial “rails” - this is true whether dealing with stablecoins, bitcoin, or any other digital asset. While this is probably obvious to most, what is less obvious is the actual impact this has on an operation dealing with these assets.

Before I transitioned full-time into the crypto industry, I was an institutional capital allocator dealing with funds, custodians, brokers, etc. In many ways, an extremely similar stack of entities and counterparties relative to what I have been dealing with in digital assets. However, I have come to find crypto structurally simpler than the traditional entities I dealt with in the past. That said, the traditional financial rails have had many more generations to build solutions that abstract away complexity. Since crypto is still a young asset class, the abstractions we are used to from the traditional world are not quite as robust. There is still a reasonable amount of operational complexity that portfolio managers, COO’s, and treasurers must deal with.

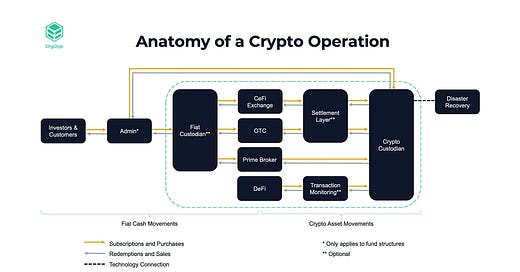

I have found a simple framework to conceptualize what a crypto operation is via a system of nodes.

The Map

A few high-level notes on this map:

Investors and customers do not necessarily need to deploy assets with fiat currency (i.e., wiring funds) if they already have crypto (e.g., stablecoins, bitcoin).

I label some nodes as “optional”. This doesn’t necessarily mean the node is unimportant. In fact, you could label many of the nodes as “optional” if you tried hard enough. For example:

You may not need a custodian if you allow the prime broker to hold your assets on your behalf.

Maybe you don’t need any centralized trading counterparties (prime broker, OTC, CeFi exchanges) if you just decide to use DeFi rails for trading/settlement/lending.

All of these decisions come with different risk trade-offs.

What are the Underlying “Nodes”?

Here is a brief description of each of the underlying entities represented by nodes:

Investor/Customer: The source of the funds that will be put at risk. May transfer via fiat (wires, ACH), or direct to crypto custody via crypto/stablecoins.

Admin: *Funds only* third-party entities who handle accounting, subscriptions/redemptions, and KYC of investors.

Fiat Custodian: Usually a bank account. Only necessary if you are sending/receiving fiat currency.

CeFi Exchange: Exchanges operated by centralized businesses.

OTC: White-glove trading services for large or bespoke trades.

Prime Broker (PB): Entities that wrap up a multitude of trading venues (exchanges, OTC) and services (lending, custody) under one umbrella.

DeFi: Decentralized financial rails. This can include trading (DEXs - Decentralized Exchanges), lending, derivatives, and more.

Settlement Layer: Off-exchange custodial wallets where your assets are segregated from a centralized exchange, but still allow you to settle PNL from trading on the exchange. Removes some counterparty risk to exchanges.

Transaction Monitoring: These are services that can monitor wallets and outgoing transactions for security criteria and potentially avoid executing malicious transactions.

Crypto Custodian: This can either be a “regulated” custodian or a custody technology provider where the operator ultimately acts as the custodian.

Disaster Recovery: Used to recover the private keys and assets of the custody solution in the event of a disaster.

Understanding Counterparty Risk Through This System

This framework is also useful for understanding operational counterparty risk. We use this framework when underwriting entities to literally map the flow of funds of their operation. This allows us to explicitly understand at which nodes assets may be transferred, and then perform security analysis on controls in place at each node junction. This is important because a major source of operational risk is at the level of the flow of funds.

About Our Work at DigOpp

At Digital Opportunities Group, we conduct risk assessments, in-depth operational due diligence (ODD), and CCSS audits to help institutional investors evaluate digital asset infrastructure. Our focus is on identifying operational gaps, custody risks, and regulatory blind spots, so investors can make informed decisions with confidence.

Our reports are available through Counterparty Catalogue, where users can explore over 100 service provider profiles, request due diligence assessments, and share or read feedback from industry peers, and more.

Recent ODD Reports:

More reports coming soon!

To learn more, contact us at info@digopp.group.

Disclaimer

We, Digital Opportunities Group Enterprises, Inc. are not providing investment or other advice. Nothing that we post on Substack should be construed as personalized investment advice or a recommendation that you buy, sell, or hold any security or other investment or that you pursue any investment style or strategy.

Case studies may be included for informational purposes only and are provided as a general overview of our general investment process. We have compiled our research in good faith and use reasonable efforts to include accurate and up-to-date information. In no event should we be responsible or liable for the correctness of any such research or for any damage or lost opportunities resulting from use of our data.

We are not responsible for the content of any third-party websites and we do not endorse the products, services, or investment recommendations described or offered in third-party social media posts and websites.

Nothing we post on Substack should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Thanks Phillip. Assuming where you say "Crypto Custodian" that could be self-custody wallets in-house...